2022’s revolving door of tax changes – discover 4 important ones you need to know about

In September, Liz Truss entered number 10 as prime minister and she appointed Kwasi Kwarteng as chancellor shortly afterwards. Within weeks both had been replaced.

While Mr Kwarteng’s time at 11 Downing Street was short, it triggered a “revolving door” of tax rule changes and U-turns that could have left your head spinning. If it did, read on to discover four changes to the tax rules you need to know about, and how they may affect you.

Before you do, let’s look at why Mr Kwarteng’s time as chancellor sparked a succession of tax rule changes.

Kwasi Kwarteng believed taxation could be used to stimulate the economy

As chancellor, Mr Kwarteng wanted to stimulate economic growth by reducing taxation so that households had more disposable income that they could spend on the high street. This was at the heart of Mr Kwarteng’s mini-Budget in September, which included several tax cuts.

While the then chancellor was convinced it was a winning strategy, the financial and money markets weren’t. As a result of the mini-Budget, the FTSE 250 – which is a more appropriate measure of the UK economy than the multi-national dominated FTSE 100 – dropped and the pound plummeted to an all-time low of $1.0327.

Both of these events signalled the start of the end for Mr Kwarteng as chancellor.

When his successor, Jeremy Hunt took over, he immediately set out to get the money and investment markets on side. This meant taking steps to reduce the UK’s debt burden, which meant increasing taxation and reversing many of Mr Kwarteng’s announcements.

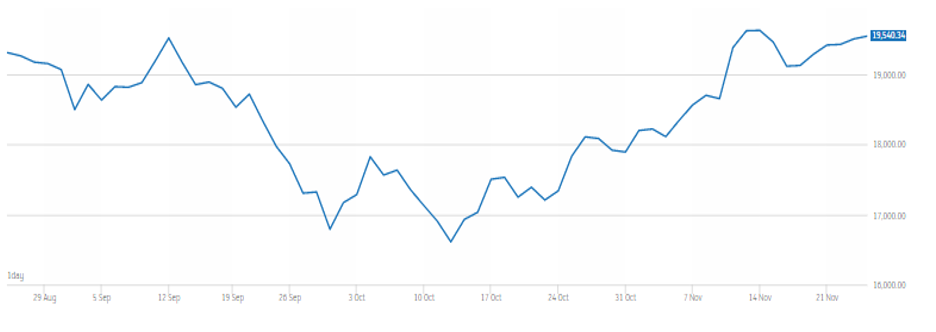

So far, the strategy seems to have worked, as the pound had rallied to $1.21 on 24 November 2022. Furthermore, the performance of the FTSE 250 has broadly improved, as demonstrated by the following illustration. It shows the performance of the index in the three months between 24 August and 24 November 2022.

Source: London Stock Exchange

Please remember that past performance is no guarantee of future performance.

Against this backdrop, you might still be wondering what the revolving door of rule changes means for your finances. We will look at this next.

1. Income Tax

In March 2022, Rishi Sunak announced that the basic rate of income tax would drop from 20% to 19% as from 2024. In the mini-Budget, Kwasi Kwarteng said he would bring this forward to April 2023, and also announced that he would be scrapping the 45% top rate of Income Tax.

This would have meant the highest rate of Income Tax would have been 40%.

That said, Mr Kwarteng did keep the Income Tax thresholds freeze. This came into effect in April 2022 and means that the Personal Allowance – which is the amount you can earn before Income Tax is charged – would stay at £12,570 until 2026.

Furthermore, the point at which you become liable to higher-rate tax would be static at £50,270, although there is more to be added to the issue of threshold freezes in a moment.

Then, when Jeremy Hunt replaced Mr Kwarteng in October, he announced that the 45% rate would remain, and said the basic rate of Income Tax would stay at 20% “indefinitely”. Furthermore, during his November autumn statement, he dropped the additional-rate threshold from £150,000 to £125,140 from April 2023.

Additionally, he also extended the Income Tax threshold freeze to 2028. These freezes, together with rising inflation, are likely to mean that millions of workers face higher Income Tax liabilities.

As clients of HarperLees Financial Planning, you know that ensuring your income is as tax-efficient as possible is central to our work. This means that if you face a rise in Income Tax, you have peace of mind that we will work with you to reduce your liability as much as possible, whether that’s via the way you take your income, a strategic use of allowances or by maximising your pension contributions.

2. Dividend Tax

If you have investments or are a business owner, the changes in the Dividend Tax rules could affect your finances. The first change to the tax was in October 2021 when Rishi Sunak increased it by 1.25% as from April 2022.

This meant that the basic-rate of Dividend Tax rose to 8.75%, the higher-rate rose to 33.75% and the additional-rate increased to 39.35%.

This increase was reversed by Mr Kwarteng during the mini-Budget, who returned rates to 7.5%, 32.5% and 38.1% – although this was short-lived. As soon as Mr Hunt became chancellor, he reinstated the 1.25% increase.

Furthermore, in November Mr Hunt announced that the Dividend Tax allowance of £2,000 would drop to £1,000 in April 2023 and £500 in 2024. With our experience of dealing with Dividend Tax, we are on hand to help you reduce your exposure to the tax.

This may include, for example, restructuring your investment portfolio to hold dividend producing investments in Stocks and Shares ISAs, which are not liable to the tax when you take an income from them.

3. Capital Gains Tax

In his November autumn statement, Mr Hunt announced that the Capital Gains Tax (CGT) threshold would drop from £12,300 to £6,000 in April 2023. Remember, profits made above the allowances will be charged at between 10-28%, depending on the type of asset sold and your marginal rate of tax.

It will then fall to £3,000 as from April 2024. While you can still benefit from the £12,300 threshold in 2022/23, there may be other steps you can take to reduce your exposure to the tax. For example, you may want to consider crystallising losses that could be carried forward to offset a CGT charge in the future.

4. Inheritance Tax

In November’s autumn statement, Mr Hunt announced that the Inheritance Tax (IHT) threshold freeze would be extended from 2026 to 2028. According to the Telegraph, the move could result in the average household’s IHT bill ballooning from £215,000 in 2019/20 to £287,000 in 2027/28.

As clients of HarperLees Financial Planning you will already know that, depending on your circumstances, you can typically have between £325,000 and £1 million in your estate before IHT is charged.

Under the threshold freeze, while the amount you can have in your estate remains static until 2028, the value of your assets, property and investments may continue to rise. If this happens your estate’s exposure to the tax, which is usually charged at 40%, could increase.

Mitigating or negating a potential IHT liability is central to the work we do, as it helps clients leave more of their wealth to loved ones. As such, you have peace of mind that we are here to help you reduce your IHT liability as much as possible.

Get in touch

If you would like to discuss the possible effects of the recent tax changes on your wealth or know someone who could benefit from a conversation with us, we would be happy to talk. Just email us at info@harperlees.co.uk or call 01277 350560.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.