3 clever steps to help your money survive the economic crisis of 2022

According to FTAdviser, the UK is the only G7 economy that remains at pre-Covid pandemic levels.. This may not come as a surprise when you consider the economic events of 2022, which include the aftermath of Kwasi Kwarteng’s mini-Budget.

Soon after the former chancellor unveiled his financial roadmap for the UK, which included a swathe of tax cuts, the pound dropped to historic lows. If that wasn’t enough, the Bank of England (BoE) announced an emergency bail-out to reassure the bond markets and mortgage lenders withdrew products over fears interest rates would spiral.

Despite government U-turns on most of the announcements made in the mini-Budget, and the appointment of Jeremy Hunt as chancellor to replace Mr Kwarteng, the UK’s economy remains uncertain.

As clients of HarperLees Financial Planning, we’re committed to providing you with peace of mind, so you may have already discussed the uncertainty and what it might mean for your wealth. That said, if you or someone you know are interested in learning why the mini-Budget created so much turmoil, and how to help ensure your money weathers the financial storm, read on.

The mini-Budget threw the markets into turmoil

Central to the former chancellor’s economic plan to reinvigorate the UK’s economy was a swathe of tax cuts. This included scrapping the 45% additional-rate of tax and getting rid of plans to increase Corporation Tax from 19% to 25% in 2023.

Unfortunately, concerns over how these cuts would be funded threw the markets into disarray, with the BoE announcing a £65 billion bailout plan to reassure the bond markets. Furthermore, sterling fell to $1.03, the lowest level on record.

While it recovered to its pre mini-Budget levels, the pound has remained on a roller coaster thanks to the uncertainty created by the former chancellor’s economic strategy. As a result of the weakness in the pound and high inflation, interest rates could rise sharply.

Even after the new chancellor, Jeremy Hunt, ditched most of Mr Kwarteng’s proposals, fears about the UK economy remain. In October, the BBC revealed that fears of an impending recession in the UK grew stronger after official figures revealed the nation’s economy unexpectedly dropped 0.3% in August.

Incidentally, the market reaction since the resignation of Liz Truss has been relatively benign, with sterling initially strengthening a little against the US Dollar as the news was unfolding. This perhaps signals that the market views another leadership contest or general election as a better outcome than Truss remaining in office.

As clients you know we are always here to discuss the economic situation and what it might mean for your investments and wider wealth. Indeed, we have already spoken to you to help you understand what is happening with the economy in Britain and further afield.

That said, if you’re interested in learning more about three clever steps you can take to help your wealth survive these uncertain times, read on.

1. Stay calm and take a long-term view

Economic downturns typically result in stock market volatility. When this happens, a common reaction is to sell investments to limit losses.

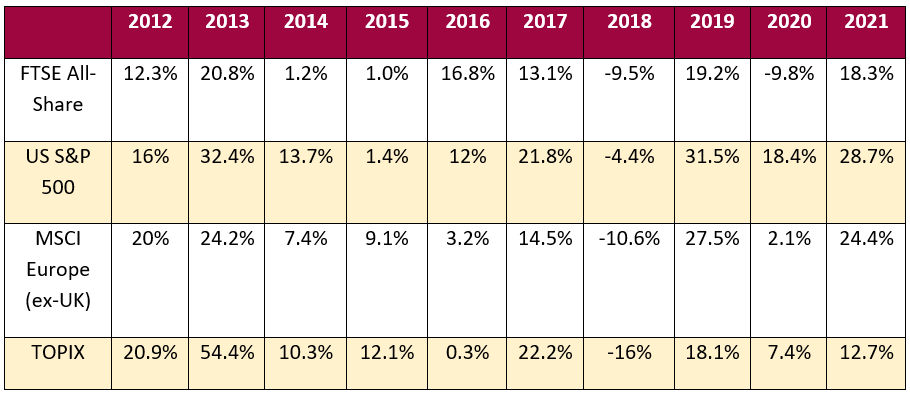

Doing this can deprive your money of the opportunity to recover and potentially grow when the stock market bounces back. To demonstrate this you might want to consider the following table, which summarises the annual return of some major stock indices during the 10 years to 2021.

Source: JP Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 January 2022.

As you can see, with one or two exceptions, stock markets over the last decade have tended to produce positive annual returns. That said, if you look at the FTSE All Share in 2018 and 2020, you can see it experienced downturns.

If as a result, you had sold your shares to limit losses, you would have missed out on the growth it then enjoyed in the following years. Always remember, previous performance is no guarantee of future performance.

2. Consider investing

Investing during an economic downturn may be something you want to think about, as it could help increase your money’s long-term growth potential. To demonstrate why, you may want to consider the following example.

If you invest £10,000 during a robust market and buy each investment unit for £2, you will have 5,000 units. This means your investment will rise to £12,500 if the unit prices increases to £2.50, providing a profit of £2,500.

If you invest when the market is experiencing a downturn, you may be able to buy each unit when it’s priced at £1. This means you will buy 10,000 units for your £10,000. If the price of each unit then increases to £2.50, your investment would be worth £25,000, providing a profit of £15,000.

Investing in a volatile market should never be done lightly, and you should aways speak to a financial planner to ensure it’s right for you.

3. Beware of holding excess cash

While rising interest rates may sound like a good thing for your wealth, care needs to be taken as holding excess amounts in cash could reduce the value of your money in real terms. This is because the interest being offered for your savings could be significantly lower than inflation, which means your money will not be keeping up with the rising cost of living.

If you look at Moneyfacts, you’ll see that on 19 October 2022 the top easy access savings account paid just 2.55%. The best five year fixed-rate only offered 4.6%. This is significantly lower than inflation, which the Office for National Statistics revealed stood at 10.1% in September 2022.

One way you may be able to inflation-proof your money is to consider investing it, as historically, the stock market has provided greater long-term growth potential than cash. Research by Schroders, for example, revealed that between the start of 1952 and the end of May 2022, UK equities returned 11.7%, while cash returned an average of 6%.

Get in touch

If you have any questions or know someone that could benefit from a conversation with us about the current economic situation, your wealth more generally or investing, we would be happy to talk. Just email us at info@harperlees.co.uk or call 01277 350560.

Please note

This blog is for general information only and does not constitute advice. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.