3 excellent reasons for your family to share the same financial planner

Although the current cost of living crisis is making it a little more common, few people choose to talk about money and personal finances with family or friends.

In fact, research from Klarna earlier this year revealed that a third of UK adults feel too uncomfortable to talk about money with their peers. Even though 44% regularly worry about money, 21% of people have never discussed personal finances with friends or family, and 34% feel too awkward to raise the subject.

Helpfully, a report from M&G Wealth suggested that one way to break this taboo is to include your family in your financial planning process.

Read on to find out why sharing a financial planner with your family can be a shrewd move for all concerned.

1. Sharing a financial planner can bring peace of mind

The recent M&G report found that only 1 in 3 families share the same financial planner.

One explanation for the 2 in 3 that do not can be attributed to a reluctance to discuss finances with families. However, we suspect that other reasons include an incorrect perception that financial planning is only relevant for those that have already built capital, and there is sadly a financial education gap for many of the younger generations.

Interestingly, the research shows that all generations are comfortable with sharing an adviser with a family member:

- 37% said they “would feel relaxed as their family already trusted them”

- 34% “liked that all the family’s finances would be in one place, so everyone could review them together”

- 28% went further still, saying they would feel “relieved they’re sharing the same adviser”.

Much of this is reflected in what we are seeing at HarperLees Financial Planning. An increasing number of clients are choosing to involve their wider family in their financial planning journey.

Sharing a financial planner needn’t mean sharing every detail of your financial plan. Sometimes, simply working in tandem with other generations can help you to create a plan that more accurately reflects your priorities, as well as working to address the situation of others.

Because you know that your loved ones are receiving expert financial advice that will help them reach their goals and achieve long-term financial security, planning as a family can also provide valuable peace of mind.

2. Financial planning as a family unit can benefit everyone

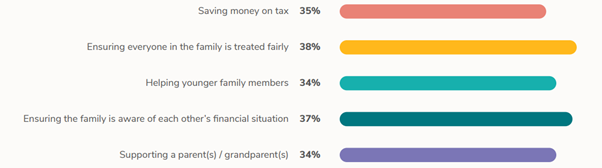

The M&G Wealth research reveals that you can gain many valuable benefits by planning as a family.

Source: M&G Wealth

The report highlighted how concerns vary between generations.

For baby boomers, the biggest concern was rising inflation, followed by their investments losing money.

Meanwhile, millennials were most concerned about not being able to save enough.

Younger generations may be struggling to get on the property ladder and put enough away for retirement as they face cost of living challenges.

Openness and honesty, especially when considering your estate planning and how to distribute your wealth, can ensure that all your beneficiaries know where they stand.

Plus, working together as a family early on can help reduce the possibility of squabbles and disagreements.

3. It can help you pass more family wealth through the generations efficiently

According to M&G Wealth, an enormous amount of wealth is due to be passed to younger generations over the next 20 years. Dubbed the “Great Wealth Transfer”, the prediction is that intergenerational transfers could reach £5.5 trillion by 2047.

This is a staggering amount of wealth to be passed through generations.

Official government figures show that estates paid a record £6.1 billion in Inheritance Tax (IHT) in the 2021/22 tax year – up £729 million (14%) on the previous year. And with the former chancellor having frozen IHT allowances until 2026, it could pay to work together as a family.

As clients of HarperLees Financial Planning, you have probably already discussed ways to protect your wealth from IHT with us. However, involving your family in your estate planning early on could make a big difference.

Another consideration is that longer life expectancy means younger generations will inherit wealth later in their life, at an average age of 61.

As a result, it may be worth exploring the option of gifting during your lifetime to help younger members of your family reach milestones sooner.

Financial planning as a family doesn’t just involve working with younger generations. If your parents or grandparents have never sought advice from a financial planner, they could have significant tax issues they have never considered. Encouraging them to work with your planner could ensure more of their wealth is passed to their loved ones, rather than lost in IHT.

If you’re interested in reading more about discussing money and finances with your family, you may find this blog useful, too.

Get in touch

We would encourage you to spread the message that financial education is valuable for all stages of life. Our range of guides can help.

Discussing how retirement will be spent will understandably fall on stony ground for a twenty-something child or grandchild when they are most interested in repaying student debt, saving for their first home, or simply having a good time! As such, our service is naturally adapted to the relevant stage of life for our individual clients.

If you’re interested in including your family in your financial planning journey or would like to introduce family members to us, please feel free to get in touch. You can email us at info@harperlees.co.uk or call 01277 350560, we’re always happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article