3 powerful facts about saving for a child, and which JISA might be best

According to recent research by the Association of Investment Companies (AIC), two-thirds of parents plan to help their children financially in the future. This might be by helping them buy their first home or perhaps with the cost of university.

The AIC goes on to reveal that while many parents and grandparents put money aside for a university fund, they then struggle to provide the intended level of financial support. This is because most people use cash accounts, which risk losing value in real terms.

So, if you’re looking to build a fund for your children or grandchildren, read on to discover why cash accounts could cost you dearly. In addition, learn how you could expose your money to greater growth potential, which may help boost the level of financial support you can provide.

1. Cash accounts provide historically low interest rates

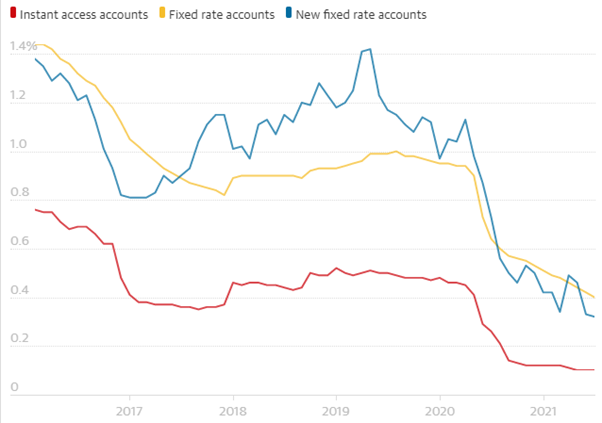

A key issue with saving in cash is the low interest rates being offered. In August 2021, the Guardian reported that the Bank of England (BOE) stated that interest rates were continuing to fall to “new historically low levels”.

This is shown in the following graph, which compares the average rates on different types of savings accounts since 2017.

Source: the Guardian

The Guardian also reveals that, in August 2021, one in eight easy access savings accounts paid 0.01% interest. This included widely held accounts with major high street banks, including the Halifax, HSBC, NatWest and Santander.

Despite this, the Independent reported that research by NatWest found 83% of parents use cash accounts when saving for children.

2. Rising inflation could devalue savings in real terms

If that wasn’t depressing enough, you then have to consider inflation. This is the rate at which the price of goods and services increase and, in the wake of Covid, it has increased significantly.

Data from the Office for National Statistics shows that inflation rose to 3.2% in August, up from 2% in July. It’s the biggest one month increase since records began.

If your savings are in an account offering 0.01%, your money could shrink in value by 3.19% in real terms. This means the money you’re putting aside for your children or grandchildren could have significantly less spending power by the time they come to use it.

3. Investing could help

There might be some good news though. Investing money you’re putting aside for future generations could expose it to greater potential growth.

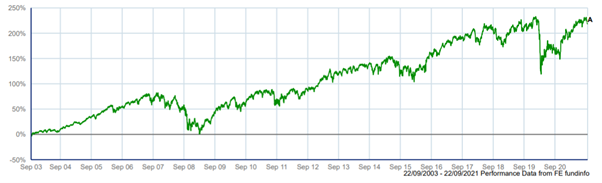

The graph below shows the performance of the FTSE 100 during the last 18 years and, as you can see, it has risen significantly in value despite downturns along the way.

Source: Trustnet

Investing has the potential to inflation-proof your money, and may increase its growth potential.

Always speak to a financial planner as they will help you understand the risks and potential rewards of investing, and whether it’s right for you. Please remember, investing should never be entered into lightly, and you should always see it as a long-term venture.

Investing in a Stocks and Shares Junior ISA (JISA) could be a shrewd move

One way you could invest money for your children in a more tax-efficient environment is to use a Stocks and Shares JISA. This not only exposes your money to greater growth potential, but any money you take from it is typically free of Income Tax.

In addition, any growth the investment makes will normally not be liable to Capital Gains Tax.

You are allowed to put £9,000 into a JISA in the 2021/22 tax year. If you do not use up the allowance you will lose it, as you cannot carry it over to the following year.

Get in touch

One consideration might be that when the child reaches the age of 18, the JISA legally becomes theirs. If you want to keep control of the cash after this point, a financial planner can help you look at other options.

If you would like to discuss a Stocks and Shares JISA, or investing for your child or grandchild’s future more generally, contact your financial planner directly. Alternatively, email us on info@harperlees.co.uk or call 01277 350560 and we’d be happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.