3 things you need to know about rising inflation and its risk to your wealth

As Britain inches towards a return to normality with lockdown slowly easing there are some encouraging economic figures.

A recent report by the Guardian reveals that the UK’s economy is predicted to grow by 7.2% in 2021, which followed data from the Office for National Statistics that showed Britain’s economy grew by 2.3% in April 2021.

The newspaper also reports the Bank of England (BoE) now estimates more than £200 billion worth of savings were built up during lockdown. In theory, that’s a substantial amount of pent-up spending yet to be released, which bodes well for Britain’s economic recovery.

While this is all very positive, there may be a fly in the ointment as some media reports and economists warn of rising inflation. This is the rise in cost of goods and services, and is used as a measure of Britain’s financial wellbeing, although if the rate is too high it could be detrimental to your wealth.

The BoE has a target of 2%, yet data shows May’s inflation rate is marginally higher at 2.1%, up from 1.5% in April. This is due to a surge in energy and oil prices as well as increased demand for clothing as retailers re-open. If you look across the pond to America, the world’s largest economy, inflation stands at 5%.

As economists warn inflation could rise in Britain, discover its potential impact on your wealth and what action you could take to mitigate it.

1. Your hard-earned money could start to lose its value in real terms

A well-known description of inflation comes from former American baseball player, Sam Ewing, who said: “Inflation is when you pay $15 for the $10 haircut you used to get for $5 when you had hair.”

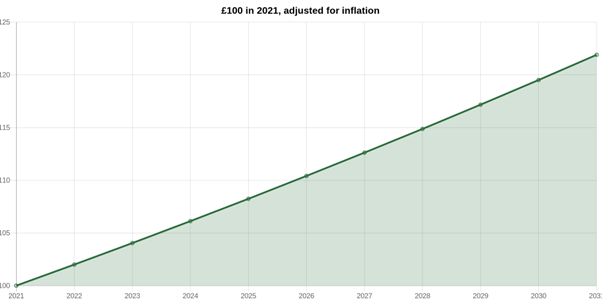

It’s a succinct way of saying that, as time goes by, the cost of living rises, meaning your money does not go as far as it used to. The following graph echoes this, as it shows that an average 2% rise in inflation over the next 10 years means you’ll need £121.90 in 2031 to have the same spending power as £100 today.

In other words, your money needs to grow by 21% or lose value in real terms.

Source: CPI Inflation Calculator

As the cost of food, the energy you use, and, potentially, cost of loans all rise due to inflation, if your money is not increasing in line with it you could struggle to maintain your lifestyle.

2. In the past, interest rates helped protect your wealth from inflation

In the past, interest rates tended to rise in line with inflation to offset its impact. Governments did this to encourage you to save and not spend, hoping it would slow the economy and stop inflation spiralling out of control.

The issue now is the UK’s historically low interest rates, with the Guardian recently reporting that the average easy access savings account rate is 0.16%, nearly 2% lower than the current rate of inflation.

However, because of the impact of coronavirus, interest rates may not rise in line with inflation.

Official figures show that Britain has borrowed £303 billion during lockdown to boost the nation’s coffers.

It’s the largest amount ever borrowed in peacetime and may present the government with a headache if the Bank of England were to increase interest rates in a bid to counter inflation. This is because it could result in the government having to pay more to service the amount it has borrowed – in much the same way mortgage repayments can rise if interest rates go up.

Because of this, and a desire to stimulate spending to help the UK’s economy get back on its feet, the BoE may delay increasing interest rates to help keep the government’s repayments down, even if inflation continues to rise. This could mean the returns you get on your money fall even further behind rises in the cost of living.

3. Investing your money could help mitigate the impacts of inflation

Typically, long-term investing provides growth that is higher than inflation. The graph below shows that while there have been downturns along the way, the long-term performance of the FTSE 100 has seen it rise from 2,337 in 1990 to more than 7,000 today.

While future performance can never be guaranteed, it echoes the 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash and other investments between 1899 and 2019. It showed that if the amount had been invested into stocks and shares in 1899, it would have grown to around £2.7 million in 2019.

One way you could invest your money is to put it into a Stocks & Shares ISA. This would potentially expose your money to long term growth and provide a tax-efficient environment for your money. You can contribute up to £20,000 into ISAs during the 2021/22 tax year.

If you have used up your ISA allowance, an alternative could be to invest your money elsewhere. As there may be tax implications it’s important to speak to us to confirm what would be appropriate for you, and discuss the potential risks and rewards involved.

Get in touch

If you would like to discuss how inflation may impact on your wealth, and potentially affect your standard of living, we at HarperLees may be able to help. Email us on info@harperlees.co.uk or call on 01277 350560.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.