4 difficult emotions that can negatively affect your investing decisions

This summer, Pixar will release its highly anticipated sequel Inside Out 2, an animated film about the emotions running the show in teenager Riley’s brain.

Joy narrates the original film, explaining the roles she and her fellow emotions Sadness, Fear, Disgust, and Anger play in helping Riley to navigate and understand the world. In this year’s sequel, Riley becomes a teenager, and Joy and her friends must make room for some new emotions: Anxiety, Embarrassment, Envy, and Ennui.

Riley’s emotions are vital for helping her to make choices that keep herself safe and happy, and she’s not the only one this applies to. Indeed, all of us are driven by emotion to some extent. While this can be helpful in some ways, when it comes to investing, it can lead to you making rash or unwise decisions.

Read on to learn more about how different emotions can affect your investment decisions, and how to mitigate their impact.

1. Fear

Fear is an important emotion for humans, as it helps us to identify threats and keep ourselves safe.

Back when we lived in caves, fear prevented us from taking unnecessary risks that could have resulted in injury or death, like attempting to hunt a larger predator. Nowadays, it’s the reason you do things like looking both ways before crossing the road.

If left unchecked, though, fear can get the better of you when it comes to investing. One way it could affect you is by causing a cognitive bias known as “loss aversion”.

Loss aversion – the fear of losing money on investments – can lead to you taking less risk on your wealth. Though it’s important to do everything possible to mitigate risk on your investments, taking too little risk could hinder your ability to generate positive returns on your wealth over the long term.

So, by letting fear influence your investing decisions, you could harm your long-term financial wellbeing as your money may struggle to grow quickly enough for you to achieve your financial goals.

2. Indifference or despair

If your portfolio underperforms, it can lead you to feel despair or indifference towards investing more generally. You might be tempted to reduce your deposits or move investments to the perceived safety of cash.

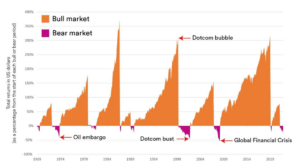

At times like this, it may help to remember that fluctuations in value are to be expected; it’s part and parcel of investing on the stock market. Historical data tells us that, generally speaking, returns usually recover fairly quickly after a downturn, as the graph below demonstrates.

Source: Schroders Personal Wealth

If you allow your emotions to convince you to stop investing, it could have a significant impact on your long-term financial wellbeing and your ability to achieve your financial goals. This is because cash savings rarely generate enough interest to keep pace with inflation. As such, over time, the buying power of your money could fall.

While it’s disappointing when your investments underperform, keep in mind that it is the long-term performance of your returns that matters, rather than any single year.

3. Excitement

Seeing your portfolio experience volatility can stir up plenty of negative emotions, but when your investments perform well, it could be a different story: elation and excitement might accompany news that your investments have grown in value.

These feelings can boost your motivation to continue investing, perhaps even causing you to consider buying more shares in the funds or companies that have performed well. But remember that past performance doesn’t guarantee future returns, so this isn’t always a sensible move.

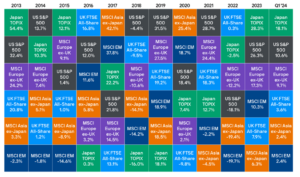

As you can see from the chart below, there isn’t a single stock market index that has outperformed all others consistently. For example, in 2021, the S&P 500 returned 28.7%, but fell by 18.1% in 2022.

Source: J. P. Morgan

As such, though it’s exciting to see your investments do well, it’s important to continue to diversify your investments to mitigate the risk that one may underperform.

4. Overconfidence

When your investments do well, it’s a wonderful feeling. You may feel more confident in your financial plan and your ability to achieve your long-term goals. But another emotion can come into play that is less helpful: overconfidence.

Becoming overconfident in your ability to identify the stocks that might perform well can cause you to tailor your investing strategy based on this belief. As such, you might choose investments on a whim rather than as a result of careful research into their long-term potential to help you achieve your goals.

Keep in mind that no one can predict what might happen next on the stock market, so only invest in diversified stocks or funds that align with your personal attitude to risk. It’s sensible to consult with a financial planner before changing how your money is invested to ensure you are fully informed of the risks involved.

Get in touch

If you’d like to learn more about how to ensure you make sensible investing decisions that aren’t influenced by fear, excitement, or any other emotions that can crop up, we can help.

Email us at info@harperlees.co.uk or call 01277 350560. We’d be very happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.