5 effective ways to successfully provide long-term financial security for your children

No matter how old your children or grandchildren are, you probably want to do everything to protect them and ensure the very best future for them. This might include helping them financially so that they can enjoy a strong financial start or have peace of mind later in life.

Whether you want to help them with the cost of university, the purchase of their first home or to ensure their retirement will be a comfortable one, there are a range of options out there.

And it’s never too early to start helping them – even if they’re currently in nappies – as the more time the money is put aside for them the greater the growth potential.

Read on to learn five ways you can help the younger members of your family enjoy a better financial future.

1. Start a pension to help ensure a comfortable retirement for your children

Starting a pension for your children may seem a little premature. If you do though, you could contribute small amounts now that could grow into substantial amounts by the time they retire.

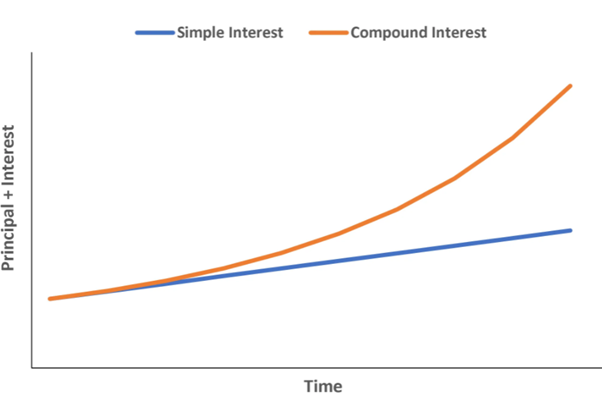

This is because of compound growth, which is where you enjoy growth on previous year’s growth. As the graph below demonstrates, this can result in much higher returns, especially over the long term as the growth made on previous year’s growth builds more and more.

Source: Corporate Finance Institute

Another reason to consider contributing into a pension is the tax relief. You are allowed to pay up to £2,880 into a pension for your child or grandchild in the 2021/22 tax year, which will be boosted to £3,600 by the additional money the government contributes.

If the child were to earn more than £3,600 a year, maybe through modelling or acting, they can contribute 100% of their income into a pension up to a maximum of £40,000 in the 2021/22 tax year.

Bear in mind that, from April 2028, the earliest the child will be able to access the pension will be aged 57.

2. A Junior ISA (JISA) could give your child a sizable tax-free sum later in life

While these accounts can only be opened for youngsters by parents and legal guardians, grandparents can still contribute towards them.

The tax-efficient accounts can be Cash or Stocks & Shares, and you are allowed to contribute a total £9,000 in the 2021/22 tax year into a JISA. If you invest into a Stocks & Shares JISA, you expose the money you put away for your children to greater long-term growth potential, free of Capital Gains Tax on any growth or Income Tax when they draw on it.

Remember though, while the money cannot be accessed by the child before the age of 18, when they do reach this age they’ll have the legal right to access and use the money as they see fit. If you have been contributing the maximum allowances annually, this may be a substantial amount.

Some parents and grandparents can be concerned about this as they fear the child may not have the life experience to handle the sum appropriately. For that reason, you may consider having other investments that are not as tax-efficient, but give you more control over how and when your child or grandchild gets access to the money.

Speaking to us can help you understand your options, and whether a Stocks & Shares JISA or alternative investments would be best.

3. Investments typically grow in the long-term, which could benefit your child

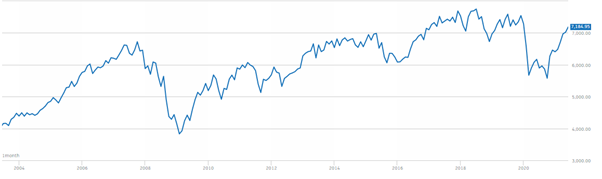

As explained above, the growth potential of investments over the long-term could be substantial – depending on what you invest in and when. This could provide enough growth to help your child or grandchild to put a deposit on a home or buy their first car.

The following chart shows the performance of the FTSE 100 index over the last 18 years. While there have been downturns along the way, you can see its value grew significantly.

As investments have tax implications, always speak to a financial planner to ensure you understand them, and the risks associated with any fund you are considering. We would be very happy to explain these to you, providing peace of mind about any decision you make.

4. Premium Bonds could provide tax-free winnings of up to £1 million

You might want to consider purchasing Premium Bonds for your children or grandchildren, which give them the chance to win tax-free prizes each month worth up to £1 million. The maximum you can invest in Premium Bonds is £50,000.

The smallest holding you can buy is worth £25, and when the child reaches 16, they become responsible for the bond and can register with NS&I to manage the account.

5. Trusts could provide more control over how the child accesses the money

Trusts can be an effective way of leaving money to your children in a way that means you could still have some control over how they access or receive the money. It’s possible to put investments and other assets into a trust that will later be passed on to the child, although there are complicated tax regulations around them, so always speak to a financial planner first.

In addition, there are different trusts, each with different rules on how your child will be able to access the assets within it. A bare trust, for example, gives the child the right to the assets when they are 18, while a discretionary trust could allow you to decide when and how the money is passed to them.

Again, a financial professional can clarify this for you, and help you understand which trust would be best for you and the child you want to invest for.

Get in touch

If you would like to discuss how inflation may impact on your wealth, and, potentially, your standard of living, we at HarperLees may be able to help. Email us on info@harperlees.co.uk or call on 01277 350560.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.