Could the rise in Dividend Tax affect you? Here’s what you need to know

After calls for the government to deal with the social care crisis in England and Wales, the prime minister announced his health and social care reforms in September 2021.

Central to the announcement was a 1.25 percentage point increase to both National Insurance contributions (NICs) and Dividend Tax, which is expected to raise £5.4 billion for social care over the next two years.

The increases come into effect when the 2022/23 tax year starts in April.

Historically, dividends have provided a more tax-efficient way for company directors and investors to take an income. With this in mind, you may be wondering what the increase means for you if you have investments that HarperLees doesn’t provide advice on.

Read on to find out, and discover clever steps that you might want to consider to make your dividends even more tax-efficient in the new tax year.

1. The Dividend Tax increase depends on your tax rate

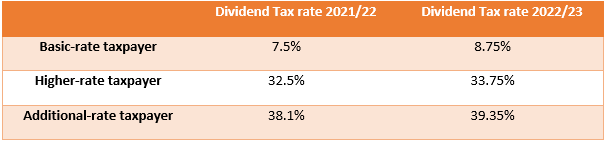

If you receive dividends from your company or investments, after Wednesday 6 April 2022 the rate changes depending on whether you are a basic-, higher- or additional-rate taxpayer. The following table shows the new rates.

You will still be able to use your individual Dividend Allowance, which remains at £2,000 in 2022/23. This is the amount you can earn in dividends before you typically become liable to Dividend Tax.

This means that if you have £50,000 invested, you typically won’t have to pay the tax if your average dividend rate is 4%. Remember, even if your dividends are above the allowance, you will not pay tax on them if your total income is within your Personal Allowance.

The Personal Allowance is the amount you’re allowed to earn before Income Tax, is due. In 2022/23 the allowance is £12,570, although if you’re a higher earner you may not receive all, or any of the allowance, so speak with us to confirm.

1. Dividends may still be a more tax-efficient option

Even with the increase, Dividend Tax could still be a better way to draw an income. To demonstrate this, consider the following.

According to FTAdviser, if you’re a basic-rate taxpayer in 2022/23, your effective Dividend Tax rate is 26.09% if the new rate of NICs are also included. This compares to 41.98% for Income Tax.

If you’re a higher-rate taxpayer you’ll effectively pay 46.34% for Dividend Tax compared to 50.67% Income Tax. As an additional-rate taxpayer you’ll pay 50.87% as opposed to 55.02% respectively.

With this in mind, taking dividends could remain a more tax-efficient way to draw an income in 2022/23.

2. You might be able to make your dividends more tax-efficient

If you have stocks and shares there are two ways you can earn from them. The first is to sell the shares if they increase in value, and the second is to take dividends.

Remember, the latter are never guaranteed and always paid at a company’s discretion. This was demonstrated in 2020 when many companies cut dividends as they looked to conserve cash during the pandemic.

That said, dividends can still be a good way of using your investments to generate an income.

If you are interested in doing some investing by yourself, you may not realise that there could be a way to make your dividends even more tax-efficient: investing into a Stocks and Shares ISA.

Any money you draw from a Stocks and Shares ISA is not liable to Income Tax or Dividend Tax. As it’s an ISA, it’s also usually free of Capital Gains Tax (CGT), meaning any growth it potentially enjoys is tax-free.

In 2022/23 you can contribute up to £20,000 into ISAs, which means you could build a significant tax-efficient investment relatively quickly. If you have old Cash ISAs, you might want to consider switching these to a Stocks and Shares ISA, as you’ll keep the tax efficiency but might expose your cash to greater long-term growth.

This is backed up by the 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash, bonds or equities between 1899 and 2019. It shows the stock market outperformed cash in 91% of 10-year periods.

It also revealed that £100 invested in cash in 1899 would be worth just over £20,000 in 2019, yet if you had put the money into stocks and shares, it would have been worth around £2.7 million.

If you’re considering this, care must be taken. We can confirm whether it’s right for you and explain any risks involved.

Get in touch

As a client of HarperLees, you can have peace of mind that we will already be ensuring that you’re using dividends where appropriate to increase your tax efficiency.

If you have other investments and would like to discuss how these might be used to generate a more tax-efficient income, email us at info@harperlees.co.uk or call 01277 350560, we’d be very happy to help.

Alternatively, if you have friends or family who you feel would benefit from a conversation with us, we would be happy to have a conversation with them.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.