3 important lessons marathon running can teach you about investing

As the evenings get lighter, you may be noticing the runners in your neighbourhood who are training for one of the many long-distance races happening in 2022.

From the Isle of Man marathon to the famous Great North Run, there are many avid runners who travel across Britain so that they can put their trainers on, pin a number to their chest, and push themselves to the limit.

Whether it’s a 13- or 26-mile run, the dedication and determination needed to complete these races cannot be overstated, and typically requires months of preparation.

As a client of HarperLees, you may know that one such runner is our very own Mark MacLean, who is currently in training for October’s London Marathon. Mark will be raising money for the Campaign Against Living Miserably (CALM), which offers support to anyone struggling with their mental health.

More details about Mark’s run and the charity can be found at the end of this blog.

While it may not be obvious, long-distance running provides excellent lessons around investing. Read on to discover three of them.

1. Know why you’re doing it

While professional athletes might run marathons for a living, most of those taking part in long-distance running do it to achieve a personal goal. That could be to complete the course, or run it in a time that’s a “personal best”.

In many ways, investing requires the same attitude, as it needs to be based on your individual goals and what you want to achieve out of life. It should never be about competing with others. Worrying about what other people are doing with their money could result in a decision you bitterly regret later.

That’s why we develop a financial strategy that’s created just for you, and is designed to help you achieve your personal goals. It also means you have peace of mind that you have a plan to achieve your aims, so you’re less likely to be concerned about what others are doing with their money.

Furthermore, we work with you to regularly review your plan, help ensure it’s on track to meet your goals, and make changes when they’re needed. Remember, we are always here to discuss your strategy if you need to talk.

2. Focus on the end goal no matter what happens

Completing a marathon is about keeping your sights on the long-term goal and overcoming the negative short-term impulses. Ask any seasoned marathon runner, and they will explain that the middle of the race is notoriously difficult, as fatigue sets in and the anxiety of not making it to the end reaches its height.

Often referred to as “hitting the wall”, it’s when runners are most likely to quit. In the same way, the key to a good long-term investment strategy is to keep going when others around you fall by the wayside.

For example, deciding to sell your investments when the stock market becomes volatile and friends or family start to sell theirs could deprive your money of future growth potential.

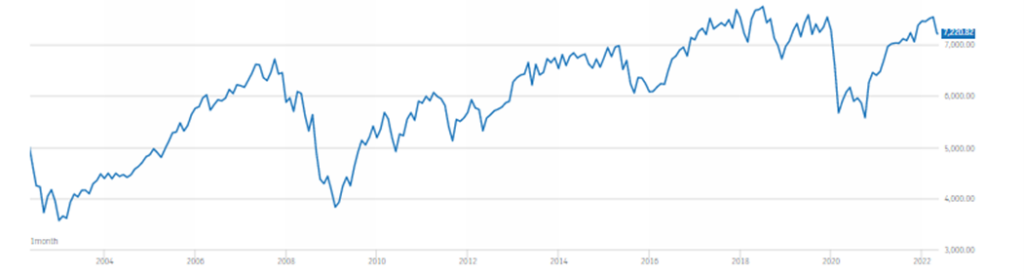

To demonstrate this, consider the graph below, which shows the performance of the FTSE 100 index in the two decades between May 2002 and May 2022. The index tracks the performance of the top 100 companies on the London Stock Exchange.

Source: London Stock Exchange

As you can see from the value along the right-hand axis, broadly speaking, the index has risen significantly in value. That said, there have also been plenty of downturns along the way, including two market crashes.

If during those downturns you had sold your investments, you could have locked in any losses you made at the time and then missed out on the subsequent growth that followed.

That’s why we are always on hand to explain what is happening to the stock market, why it might be volatile, and what the best strategy is for you.

3. Don’t lose focus

Few marathon runners who are serious about their sport would ever stop training between races. The weeks spent on the settee instead of training are lost forever, and could cost them a time that’s a personal best, or the ability to finish the race.

In much the same way, investing is about remaining focused on your investments and what you need to do to keep them on track. Just as runners maintain their training schedule, investors should take time to consider their finances, review their financial strategy, and consider whether they are being as tax-efficient as possible.

Of course, as your financial planners, we will be involved with this. By holding annual reviews and letting you know when you need to act, we do much of the heavy lifting for you.

Get in touch

In the same way as runners use personal trainers and coaches to improve their time, we are here to help you get the best from your money and wealth. If you have friends or family who might benefit from our coaching and expertise, please let us know as we’d be happy to help them.

Just email us at info@harperlees.co.uk or call 01277 350560.

Support Mark at the London Marathon

This year Mark will be running the London Marathon to raise money for the Campaign Against Living Miserably (CALM). The charity works with those who feel suicidal, no matter who they are, and provides a free, confidential online and telephone helpline.

For more information about CALM’s work, please visit the website. If you would like to sponsor Mark’s run, visit https://tcslondonmarathon.enthuse.com/pf/mark-maclean-8c01c as your generosity would be greatly appreciated.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.