Buy-to-let or stocks and shares: which investment is right for you?

As Brits, we are famous for our love of property, so it’s no surprise that many investors look to buy-to-let houses as a potential investment opportunity. But how does this stack up against a more traditional stocks and shares portfolio?

With so many factors to consider, as well as your own aspirations and values, it can be tricky to know which would be more suitable if you’re looking to invest. In this article, you can learn more about the pros and cons of each approach to help you make an informed decision about what might be right for you.

It can be tricky to estimate what the rate of return might be on a buy-to-let property

You can draw on over 100 years of data to estimate the sort of returns you might expect from an investment in the stock market. Remember, though, past performance cannot guarantee future performance.

Business Insider shares that the average annual return on the S&P 500 since it was introduced in 1957 has been around 10.7%. From 2013 to 2023, the average annual return was slightly higher, at around 12.39%. IG reports that the annualised return for the FTSE 100 between 1984 and 2022 was 7.4%, though this drops to 6.3% for the period between 2012 and 2022. Again, these figures only indicate what has happened historically and do not guarantee what could happen in future.

Estimating the rate of return on a buy-to-let property, however, is much trickier, as you must calculate your potential rental “yield” – the percentage of the purchase price that your rental income will amount to.

Some of the factors that might affect the rental yield on your buy-to-let property are:

- Where your property is situated

- The associated costs of purchasing and letting the property, such as conveyancing, letting agent fees, mortgage repayments, and Stamp Duty

- Any other costs, such as repairs and upkeep.

The Telegraph shares a helpful example to demonstrate the potential profit of a rental property in Sheffield, where the average house price is £238,000.

The example assumes that you:

- Pay a deposit of £85,000

- Use a further £15,000 to cover the costs of buying such as legal costs and Stamp Duty

- Borrow the rest of the purchase price on a mortgage at a rate of 5.25% over 25 years

- Must pay maintenance costs of 10% of the rent and a management fee of 12% of the rent

- Don’t have to cover any unexpected costs while letting your property, such as repairs.

Based on these assumptions, you could achieve an annual return of around 2% after costs. This would amount to around £20,000 over 10 years.

If you managed the property yourself rather than using a letting agent, your rental yield could rise to 3.5%, generating £35,000 in pre-tax profits over 10 years.

The report suggests that if you were to buy a property in an area that offers higher rental yields, you may be able to generate higher profit. In Glasgow, where the average rental yield is 7.4%, it might be possible to double your returns over 10 years.

These profits are in addition to any returns you might make when selling the property later on.

There are more opportunities for tax efficiency with an investment portfolio than buy-to-let property

The exact tax liability on either type of investment will partly depend on your personal circumstances, but there are some tax rules that can help you to determine the potential level of tax that could be payable.

You can hold your investment portfolio in a Stocks and Shares ISA, shielding your returns from Capital Gains Tax (CGT). It’s important to note, though, that you can only contribute funds up to the value of the ISA allowance each tax year, standing at £20,000 in 2024/25. If you wanted to invest more than this, the excess would need to be held in a different type of account and may be liable for CGT.

Meanwhile, the rental income that you generate from a buy-to-let property may be liable for Income Tax, though this can be offset to a certain extent with allowable expenses. When you come to sell the property, the proceeds are likely to be liable for CGT at a higher rate than stocks and shares – 18% for basic-rate taxpayers and 24% for higher- and additional-rate taxpayers.

Moreover, tax breaks that landlords used to be able to claim are no longer available. For example, it is no longer possible to deduct your mortgage interest from your profits. Instead, you will receive a 20% tax credit on your eventual bill.

So, when deciding whether to invest in stocks and shares or buy-to-let property, remember to include the possible tax liability in your calculations about value for money and potential returns.

In the UK, property investments are often seen as “safe”, but diversification is still important

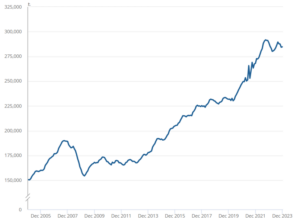

Property is often seen as a “safe” investment, particularly here in the UK where many people aspire to own a home. While it’s true that house prices have tended to rise over the past few decades with the occasional short-term drop – as you can see on the graph below – past performance is no guarantee of future performance.

Source: Office for National Statistics

What’s more, a property investment is not diversified, so if the property value does not rise, or worse, falls, you don’t have a balanced portfolio to recoup these losses.

In an investment portfolio, it’s much easier to diversify your investments and mitigate risk. A diversified portfolio might include global stocks and shares, bonds, and cash. By investing in a range of asset types, sectors, and locations, you can mitigate risk, as any losses you experience from underperformance might be offset by other investments.

The level of risk that you wish to take on your investments – whether you opt for stocks and shares or property – will be personal to you. Your planner can advise on the most suitable asset classes and sectors for you, so that you have the opportunity to grow your wealth and achieve your goals within the required time frame.

It’s not just the financial aspect that you need to consider

As well as the financial considerations, it may also be sensible to consider the “hassle factor” involved in each type of investment.

An investment portfolio requires relatively little effort on your part, particularly if your financial planner helps you to manage the investments.

A buy-to-let property, on the other hand, can be a significant time investment, particularly if you choose to manage the property yourself. As well as finding a tenant and collecting the rent, you may need to organise and pay for repairs and upkeep.

What’s more, it can be time-consuming to sell the property if you decide that you need access to the funds you have invested. You will need to wait until the end of your tenant’s contract to be able to sell, and must then find a buyer, which could take time depending on the property market at the time. An investment portfolio is much more flexible, as you can usually buy and sell investments within hours if needed.

Get in touch

If you would like to learn more about whether a buy-to-let property or investment portfolio might be a suitable way for you to grow your wealth and achieve your goals, please get in touch. You can email us at info@harperlees.co.uk or call 01277 350560. We’ll be very happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages.