Could these 5 common Inheritance Tax myths be affecting your estate plan?

More people in the UK are becoming concerned that their loved ones may face an Inheritance Tax (IHT) bill after they pass away.

A report from FTAdviser reveals that 35% of Brits have concerns about IHT. It’s understandable, since tax rules can be complex. But misinformation can add to these concerns unnecessarily.

Myths abound about when IHT might be payable and who it does and doesn’t apply to. Read on to learn five of the most common myths and the truth behind them.

1. “Your partner won’t need to pay Inheritance Tax on your estate when you pass away”

If you are married or in a civil partnership, it’s true that you can leave your entire estate to your spouse and they won’t need to pay IHT on it.

However, this isn’t possible if you and your partner are unmarried, as is the case for a growing number of people in the UK. No matter how long you have been with your partner, if you’re unmarried, you don’t have any legal rights to their estate after they pass away.

Even if your partner leaves their estate to you in their will, if it exceeds the nil-rate band (£325,000 in 2024/25) in value, it may be necessary to pay IHT.

2. “Only the wealthiest estates are liable for Inheritance Tax”

While it’s true that not many estates in the UK are liable for IHT, the number of people paying it is likely to increase over the coming years. This is because the nil-rate band and residence nil-rate band have both been frozen until 2028.

With these thresholds frozen, but the value of property and assets rising over time, within a few years, more estates are likely to have to pay IHT.

Even if you think your estate may not be liable for the tax, it may be sensible to obtain an up-to-date valuation of your property and other assets for a more accurate understanding. The Office for National Statistics shares that, as of December 2023, the average value of a property in the UK was £285,000.

So, your estate may be worth more than you realise.

3. “Financial gifts you give are exempt from Inheritance Tax”

Gifting can be a helpful way to mitigate a potential IHT bill, but there are some tax rules surrounding this that you need to be aware of. Not all financial gifts will be automatically exempt from IHT.

- The annual exemption means that you can gift up to £3,000 a year free from IHT.

- In addition, you can give up to £250 to as many people as you like, provided they haven’t received a financial gift under your £3,000 annual exemption.

- If your child is getting married, you can gift £5,000 for their wedding or civil ceremony. For a grandchild or great-grandchild who is getting married, this allowance falls to £2,500, or £1,000 for anyone else.

- You can give an unlimited amount of regular financial gifts to friends or family using surplus income, provided it doesn’t affect your ability to maintain your standard of living.

Financial gifts outside of these allowances are known as “potentially exempt transfers”. They could be free from IHT if you live for seven years after giving them.

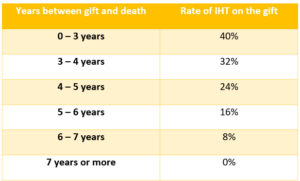

The rate of IHT that may be payable if you pass away before this depends on the length of time between you giving the gift and passing away.

Read more: 6 practical ways you could use gifting to reduce your IHT liability

4. “Your family will only pay Inheritance Tax on anything above £1 million”

This is another myth that may be true under certain circumstances, but it certainly won’t apply for everyone.

If you are married or in a civil partnership, you can leave your entire estate to your spouse free from IHT. When they pass away, you can combine your respective nil-rate bands and pass the estate on to loved ones.

In 2024/25, the nil-rate band is £325,000, and the residence nil-rate band is £175,000. This means that if you are leaving your home to a direct descendant, you can each pass on assets worth up to £500,000 without any IHT liability. When you combine these two allowances, as a couple, you could leave up to £1 million to loved ones free from IHT.

Anyone with a net estate over £2 million will begin to see their residence nil-rate band reduced by £1 for every £2 over this threshold.

So, you may be able to pass on up to £1 million free of IHT as a married couple, but only under specific circumstances.

5. “You can leave your home to your children and it won’t be liable for Inheritance Tax”

The residence nil-rate band means that, if you are leaving your home to a direct descendent after you die, some of it may be free from IHT. In 2024/25, the residence nil-rate band is £175,000.

When combined with the nil-rate band of £325,000, this means that you could leave up to £500,000 to your children or grandchildren, provided your home is included in this, without them having to pay IHT.

Of course, as property prices rise over time, it’s possible that your home may be worth more than this by the time you pass away. So, your beneficiaries may still need to pay some IHT depending on the value of the property when they inherit it.

Get in touch

If you’re concerned that your estate may be liable for IHT after you pass away, we can help you to mitigate this potential bill and pass on your wealth tax-efficiently to your loved ones.

Email us at info@harperlees.co.uk or call 01277 350560 to learn more.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning or tax planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.