Could you be one of millions paying tax on your savings interest in 2024?

For much of the past 10 years, interest rates in the UK have been exceedingly low. They were so low that it was extremely difficult to generate a meaningful amount of interest on cash savings. But over the past year, that has changed.

In August 2023, the Bank of England (BoE) raised the base rate for the 14th consecutive time, taking it to 5.25% in order to bring inflation back to its 2% target. This has brought interest rates to their highest level in over a decade, which has been great news for savers who have been able to grow their cash savings more quickly.

But with the higher interest rates comes a potential tax liability. For cash savings that aren’t held in a tax-efficient wrapper like an ISA, interest generated could be liable for Income Tax if it exceeds your Personal Savings Allowance (PSA).

MoneyWeek reports that, due to rising interest rates, HMRC expects that 2.73 million people may need to pay tax on their savings interest in 2023/24, around 1 million more than in 2022/23.

Read on to learn more about whether you may need to pay tax on your savings interest and some practical steps you can take to mitigate your bill.

The Personal Savings Allowance limits the amount of interest you can generate before tax may be payable

Most people are entitled to a PSA each tax year, so any interest you earn on your savings that exceeds this allowance could be liable for Income Tax.

In 2024/25, the PSA is:

- £1,000 for basic-rate taxpayers

- £500 for higher-rate taxpayers

- £0 for additional-rate taxpayers.

If the amount of interest that your savings generate exceeds the PSA for your tax bracket, you may need to pay Income Tax on the excess at your marginal rate.

Higher interest rates mean you are more likely to generate enough interest to exceed your Personal Savings Allowance

In the past, when interest rates were much lower, it was difficult to generate enough interest for the PSA to be relevant for many people. But as the BoE has increased the base rate, more high street banks and building societies have increased the rates they offer on cash savings accounts too. So, you now need a much lower amount in savings to generate the level of interest that could exceed your PSA.

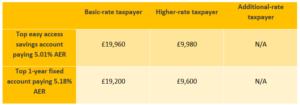

The table below shows the total amount you would need to hold in a cash savings account offering the highest interest rate to earn enough interest to be liable for Income Tax. You’ll notice that, particularly if you are a higher-rate taxpayer, it could be quite easy to generate enough interest to be liable for Income Tax.

Source: MoneySavingExpert. Rates correct as of 21 May 2024. Assumes constant balance.

Saving into a tax-efficient wrapper could help you mitigate your tax bill

Fortunately, if you believe your savings interest may be liable for Income Tax, there are some tax-efficient wrappers you could use to hold your cash savings.

1. Cash ISA

An ISA is a tax-efficient wrapper that shields your savings interest from tax. You can save up to £20,000 into an ISA in 2024/25, which could save you a significant amount in Income Tax compared to holding the same amount in the highest-paying cash savings accounts.

There are several types of Cash ISAs that you can choose from to suit your needs, including easy access, fixed-term, or Lifetime ISAs.

2. Premium Bonds

If you have exceeded your ISA allowance for the year, Premium Bonds could offer an alternative tax-efficient wrapper.

Unlike ISAs or savings accounts, Premium Bonds don’t pay interest on your savings. Instead, each £1 bond that you purchase is entered into a monthly draw, and you can win tax-free prizes ranging in value from £25 up to £1 million.

It’s worth bearing in mind that there is no guarantee you will win anything in Premium Bonds, so your savings may not grow. NS&I reports that the prize rate for Premium Bonds is 4.4% as of March 2024, with odds of 21,000 to 1 of winning for each £1 bond.

3. Pension

As well as helping you to prepare for retirement, your pension is a highly tax-efficient way to save. This is because you can receive tax relief at your marginal rate on contributions up to the threshold of the Annual Allowance. Moreover, while your savings are held in your pension, you won’t pay tax on the returns they accrue.

In 2024/25, the Annual Allowance is £60,000 or 100% of your earnings if lower. You may have a lower Annual Allowance if you are a high earner or if you have already begun to withdraw a flexible income from your pension.

Get in touch

If you’d like to know more about how you can save more tax-efficiently, please get in touch. We can help you to create a financial plan that grows your wealth and helps you to achieve your long-term goals.

Email us at info@harperlees.co.uk or call 01277 350560. We’ll be very happy to help.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.