It Won’t Be Like This All The Time – 03.04.20

It Won’t Be Like This All The Time

It is easy to forget that the world moves on, when our daily newsfeed understandably continues to be dominated by Covid-19. We have seen further support from the UK government which brings the self-employed broadly into line with the safety net provided for employees.

Whilst we cannot arrange face to face meetings, we are fully set up to be able to do webcam or telephone meetings with all staff continuing to work at home. It is reassuring that we have also had several new enquiries this week that have been referred by our clients.

Next Monday brings the new tax year and we have included below the key allowances and changes for your reference, together with additional ideas for ‘things to do’ and some news updates from HarperLees.

Ideas and Assistance

After our request last week for ideas of things to do during these ‘self-isolation’ times, we received the following suggestions:

The Shows Must Go On – A selection of Andrew Lloyd Webber and Tim Rice musicals will be available free each week for 48 hours. The next show is Joseph and the Amazing Technicolour Dreamcoat on Friday 3 April and can be found here

Other stage shows are also available free of charge at filmedonstage.com

Nature – Chris Packham, from BBC’s Springwatch is providing nature videos from his home in the New Forest, with details here

Music – Mark MacLean recommends listening to the new Lanterns on the Lake album, Spook The Herd. Although released before the Covid-19 impact, its themes of sticking together to counter against the world’s problems and divisions seems strangely prophetic. The band’s website can be found here which includes a YouTube link to hear the album, and to buy vinyl and cd versions.

Please continue to share your ideas and recommendations.

Markets

Since our last newsletter, stockmarkets have remained volatile although thankfully not to the same extremes we saw earlier in March.

There are two natural questions that can arise:

- Should we sell out to protect against further downside risk?

- Does this create an opportunity to invest and seek to capitalise on the lower asset valuations?

The appropriate question will typically be determined by your personal risk willingness, time before the money will be required and whether you are seeking to recover or to speculate.

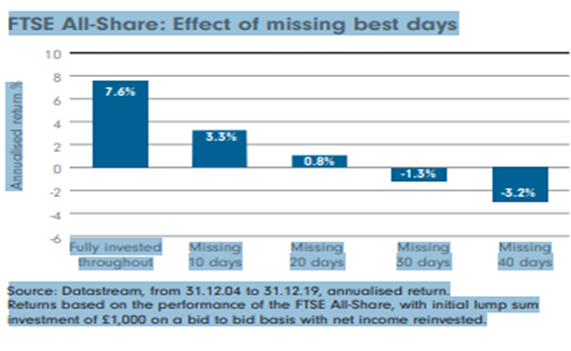

Both questions can point to whether it is possible to consistently time the markets. An inherent human reaction can be to try to second-guess the market ups and downs, for example turning paper losses into actual losses, or not investing until ‘later’. However, this brings the risk of missing out on future gains when the markets do bring recovery. The following chart from Fidelity International shows what would have happened to the annualised returns if investing £1000 in the FTSE All-Share Index from 2004 to 2019, but missing out on the best days:

Whilst recognising that past performance is not a guarantee of the future, the contrast in returns is significant and supports our view that portfolios should remain invested after the recent difficulties.

For those considering new investments, a prudent approach would be to phase in cash over an initial period.

Tax Year 2020/21

The Budget on 11 March 2020 was dominated by Covid-19 related measures. The key changes for financial planning purposes can be summarised as:

Capital Gains Tax – The allowance increases to £12,300 for individuals and £6,150 for trusts.

Income Tax – No changes to the Annual Personal Allowance which remains at £12,500.

National Insurance – The threshold for National Insurance will be increased from £8,632 to £9,500 as of April 2020.

ISAs – ISAs continue to allow £20,000 per individual, although for under-18s, the Junior ISAs were increased from £4,168 to £9,000 each.

Pension Contributions – Changes to the ‘high-earners’ regime which previously restricted the annual allowance on earners over £110,000. The annual allowance will be £40,000 unless earnings exceed £200,000 when tapering applies. For earnings above £300,000, the allowance will be reduced to £4,000 pa.

We will consider the use of the appropriate allowances and tax changes as part of our ongoing financial planning service, although please let us know if you would like to discuss your situation.

News from HarperLees

SOLLA, the Society for Later Life Advisers, specialising in providing guidance and advice on funding long term social care fees, have recently confirmed Adrian’s successful application for re-accreditation.

The Later Life Accredited Adviser (LLAA) status has to be to be re-assessed every 5 years and is subject to a SOLLA Panel decision, following a detailed analysis of Adrian’s specialist knowledge through a case study based interview, evidence of actual advice delivered and a review of his Continuous Professional Development.

Adrian is one of just 5 SOLLA accredited specialist later life advisers in Essex and is also a SOLLA Retirement Advice Standard holder. Further information can be found on our website here

https://harperlees.co.uk/later-life/

Chartered Financial Planner Firm

We were recently interviewed by the Chartered Insurance Institute which included our views on the importance of the Chartered accreditation to our culture, our clients and our staff.

The article can be found here

Personal Finance Society

Mark recently presented at a Personal Finance Society workshop to the members on Planning on Divorce alongside two Family Lawyers, Karen Taylor of Essex Family Law and John Darnton of BDB Pitmans. The session highlighted the opportunities to provide vital education and financial planning advice to those going through an often traumatic and life-changing experience.

Mark was also delighted to receive an award from Keith Richards, CEO of the Personal Finance Society at the annual Officers Conference. This recognised feedback scores from the Essex region members on Mark’s role as Chair.

Contacts

We remain available, and please feel free to contact us for any assistance whether advice-related or simply for a general catch up.

Stay safe and we look forward to catching up soon.