HarperLees reflect on 2024 and briefly look ahead to 2025

As we begin 2025, we thought it timely to take a quick look back at 2024:

Portfolios and markets

- Following late 2023 which saw stock markets finally show recovery as inflation eased around the world, 2024 continued that path with positive returns for much of the year. We saw a pullback in December 2024 due to some concerns, including sticky core inflation, which means central banks are stalling their rate-cutting programmes.

- Closer to home, we have seen pressure on sterling and UK gilt yields as investors fret about fiscal sustainability after the November Budget.

- However, the following chart shows performance from a range of risk-adjusted sector averages which indicates good returns overall for 2024, across the range of risk profiles:

Remember, past performance is not a guarantee of future returns.

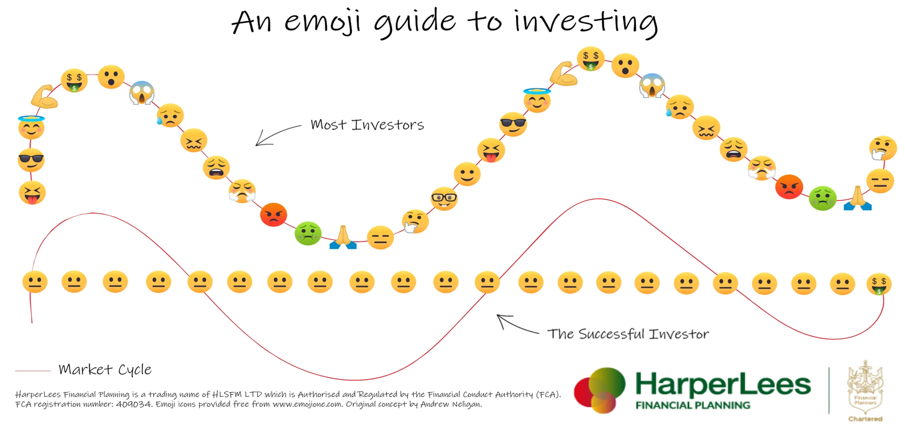

While the short-term focus is useful, it is always most important to “zoom out” on the longer term, as we are most interested in ensuring your portfolio can support your financial plan and objectives, over the whole range of market conditions!:

Supporting Kids Inspire – Our charity for 2024 and 2025

We have decided to extend our support for Kids Inspire into 2025 too.

Kids Inspire aims to provide holistic specialist services to young people and their families affected by trauma or negative experiences.

It’s a huge compliment when our clients recommend HarperLees service to others and we will continue to make a payment of £50 to Kids Inspire for each new introduction that leads to an exploratory meeting.

HarperLees Team

We welcome Danny Price who recently joined the team as a Client Administrator. Learn more about Danny next month, when he stars in our Meet the Team article.

Get in touch

If you’d like to know more about how we can support you in achieving your financial goals in 2025 and beyond, please contact us today.

You can email us at info@harperlees.co.uk or call 01277 350560. We look forward to speaking to you.