How index-linking financial protection could ensure your family’s welfare

As 2023 started, the evidence suggested that the soaring cost of living that Britain had endured in 2022 was at long last starting to ease. In January, the Office for National Statistics (ONS) revealed inflation had dropped to 10.1%, from 10.5% the month before.

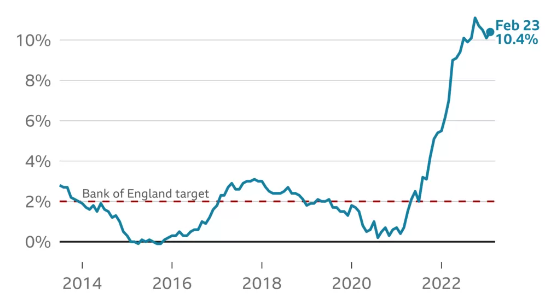

While January’s rate was still in double figures, it provided hope that inflation was at least heading in the right direction. Unfortunately, this may have been short-lived, as in February 2023 there was an unexpected increase in Britain’s rate of inflation.

It rose to 10.4% thanks to a surge in the cost of drinks, meals out and fresh food. According to the Guardian, the ONS revealed that the cost of food and non-alcoholic beverages had risen by around 18% in the 12 months up to February – the highest rate since August 1977.

You may have seen the effects of higher inflation on your monthly outgoings, yet it could also jeopardise your financial security if anything unexpected and unwanted happened to you. This is because inflation may mean that your financial protection is no longer able to support your family’s standard of living.

While this is less likely to be the case if you’re a client of HarperLees Financial Planning, read on to discover why someone you know may be affected. First, we need to consider how inflation works.

The inflation rate is a measure of the average price rise of goods in the UK

Inflation measures the rising cost of living over the long term. As prices rise, your money has less purchasing power, which means it’s falling in value in real terms.

While low levels of inflation are seen as good for the economy, if it rises too high it can be damaging to the economy, as for example, the cost of raw materials can spiral. This is why the Bank of England (BoE) is targeted to keep it at 2%.

In the wake of the covid pandemic and the war in Ukraine, inflation skyrocketed in 2022 after remaining at historically low rates for several years. This is demonstrated in the following illustration.

Source: BBC

Inflation could reduce the value of your protection in real terms

Financial protection is designed to help you (or your family) maintain your lifestyle should the worst happen. Life cover typically provides for your loved ones should you pass away, while critical illness cover or income protection allows you to retain your standard of living if you’re unable to work due to health reasons.

To explain how inflation can affect financial protection, you might want to consider the following. Imagine that you had taken out a life insurance policy 20 years ago for £100,000. At the time, £100,000 may have been exactly what your family needed to continue with their way of life after your death.

If you use an inflation calculator you will see that you need £206,485 in January 2023 to have the same spending power as the original £100,000 did in January 2003. This means that your money needed to more than double to keep pace with inflation, so that your life assurance had the same spending power as 20 years ago.

Worse still, that was at an average inflation rate of 3.75% a year, significantly lower than the inflation rate of February 2023.

There is good news though, as you can ensure your protection rises in line with the cost of living using “index linking”. Let’s look at this in more detail next.

Index linking your protection could ensure that it retains its spending power

In short, index linking ensures that your financial protection keeps pace with inflation. This means that if you do need to use your protection policy, it will have the same spending power as it did when you first took it out.

Most life insurance, critical illness cover, and income protection providers offer indexation as an option, and as a client of HarperLees Financial Planning, we will typically have advised you to take it.

Doing so means you can rest easy, knowing that you or you and your family will receive the level of payment that allows you to maintain your (or their) standard of living. You can also relax in the knowledge that if you do have a serious illness, you’ll have sufficient funds to keep you going while you’re unable to work.

It should be noted that index linking cannot typically be added later and should usually be included when you take out your protection. Conversely, you can often decide to stop index linking your cover at a later date.

Get in touch

If you know someone who may benefit from a conversation with us about index linking their financial protection products, to ensure they can maintain their lifestyle if the unexpected happens.

Just email info@harperlees.co.uk or call 01277 350560, and we’d be happy to help.

Please note

This blog is for general information only and does not constitute advice. It should not be seen as a substitute for financial advice as everyone’s situation will be different.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The information is aimed at retail clients only.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.