How to develop the right mindset for genuine financial peace of mind

Do you consider your “future self” and how you would want your lifestyle to look years from now? If you do, you may be surprised to learn that many people don’t, and it’s likely to be detrimental to their long-term financial wellbeing.

That’s according to research carried out by Aegon. Its Financial Wellbeing Index shows that people who have financial peace of mind are not necessarily wealthy, with one third of top earners saying they are stressed about money.

Researchers found financial wellbeing is as much about enjoying life and appreciating your own self-worth as the amount of wealth you have. In its conclusions, Aegon suggested people develop five “mindset building blocks” that could help increase enjoyment in life and promote feelings of self-worth, both of which are key to achieving financial wellbeing.

Read on to learn what these five mindset building blocks are and how they can help you achieve financial peace of mind.

1. Knowledge of what makes us happy

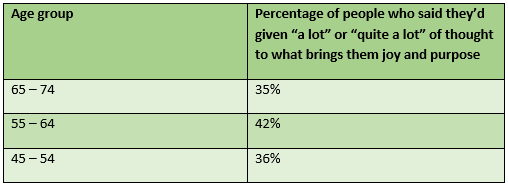

As the following table from the research shows, only 40% of us think about what provides joy and purpose in life despite the fact this is key in achieving financial wellbeing.

Indeed, the study suggests that striving to own “more” instead of understanding what makes you happy could create stress around money.

This is something we as financial planners understand very well, which is why we work to understand your life goals and what you enjoy doing, and look for ways to help you create the money to do more of it.

For example, using financial software such as cashflow modelling, we can help you understand whether you can afford to spend less time working and more time doing the things you like.

In addition, we also work with you to make sure your wealth is working as effectively and tax-efficiently as possible, providing you with the financial support you need to live the life you want.

2. Have a solid picture of your future self

Knowing what you want in life can help improve the financial decisions you make, according to Aegon. As part of the study, researchers found that those who had a solid idea of how they wanted their future to look were more likely to contribute to long-term savings or Stocks & Shares ISAs, creating greater financial security and flexibility in the future.

Helping you develop a clear understanding of how you want your future to look is fundamental to our work as holistic financial planners. By truly understanding your goals in life and what your ambitions are, we can work with you to help you achieve them and live a better, happier and more enriched life.

In other words, we work to provide you with the confidence you need to make the decisions today that you’ll thank yourself for in the future.

3. Have a long-term plan

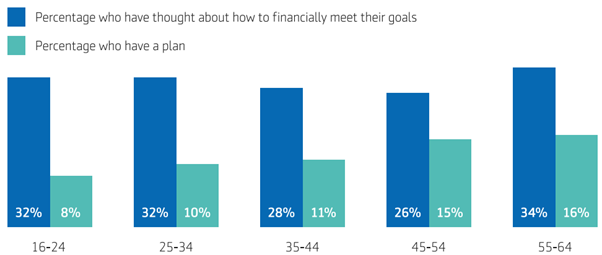

One of the most revealing graphs of the research is shown below. It shows that around one third of people consider their long-term goals, yet only a fraction of these people create a long-term plan.

Source: Aegon

Having a plan can be key to achieving goals. It can be referred back to regularly, helping you focus on what needs to be done now, and what’s important to you in the future.

Holistic financial planners like us take time to create plans for you, that allow you to see where you’re going and how far you’ve come.

A key point here is ensuring your plan takes into account every aspect of your life. We always do this, as it greatly reduces the possibility of life throwing an unexpected curve ball, which knocks your plan off course.

It also ensures any strategy recommended is likely to be the best one for you, and the most tax-efficient, helping you achieve greater financial peace of mind.

4. Savvy social comparisons

According to the research, most of us compare ourselves to others. This is where a holistic financial planner can help you understand where you are financially in life, and help you feel good about what you’ve achieved.

It can be easy to lose sight of what we’ve achieved when we benchmark ourselves against others, potentially resulting in a poor decision we later regret. Working with a financial planner can help you avoid this.

5. Strong nerves in a crisis

Researchers found that one in seven (14%) investors sold out during the last downturn in the markets, despite it potentially leaving them worse off.

As the graph below shows, after investments fell in 2020 due to the coronavirus pandemic, the main American market indexes made a strong recovery. This means that if the investors had panic sold in March 2020, they would have missed out on the subsequent growth that would have allowed them to recover their losses.

Source: Statista

As a holistic financial planner, we can help you understand why a downturn in the markets has happened, giving you the confidence to make a well thought-out decision and not a knee-jerk reaction to bad news you later regret.

Get in touch

If you would like to discuss how we can help you develop your money and mindset building blocks, please email us on info@harperlees.co.uk or call on 01277 350560.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.