National Insurance and Dividend Tax rise as government suspends State Pension triple lock

This week, the government has made two major policy announcements that are likely to directly affect your finances.

A much-anticipated National Insurance rise will result in an increased burden on workers including, for the first time, those above State Pension Age.

In addition, the government has suspended the State Pension triple lock, meaning that pensioners will receive a much more modest increase than anticipated.

Read on for everything you need to know about these policy changes.

The new “health and social care levy” will push up National Insurance bills by 1.25%

Despite a clear commitment in their last election manifesto not to raise taxes, the government has unveiled a 1.25% hike in National Insurance contributions from April 2022. This is to raise additional revenue to fund health and social care.

From April 2022, employees will begin to pay the levy through an increase in their National Insurance contributions. The 1.25% increase will also be levied on employers.

This additional contribution will then become a “health and social care levy” from April 2023 and will appear as a separate deduction on payslips.

According to the Guardian, an individual earning £50,000 can expect to see their National Insurance contributions rise from £4,852 to £5,357 each tax year, equivalent to a £505 tax increase. If you earn a salary of £100,000, you can expect your annual contributions to rise by £1,131.

The government says that, for the next three years, the tax increase will generate an additional £12 billion a year for health and social care. Of this, they have earmarked £5.4 billion over the period specifically for social care, with another £8.9 billion going on what is termed a “health-based Covid response”.

Once the NHS backlog starts to clear, ministers say that more of the money will go to social care, although how this will happen has not been set out.

Extra money will also be sent from Westminster to Scotland, Wales, and Northern Ireland, which the prime minister said would receive more money than they paid in, as a “union dividend”.

A million working pensioners will pay National Insurance for the first time

In another radical reform, around 1 million working pensioners will pay National Insurance contributions on their earnings from 2023.

Under the current system, taxpayers stop making National Insurance contributions when they reach 66, the point at which the State Pension kicks in.

It will be the first time that a government has asked pensioners to pay, with contributions starting at a rate of 1.25% in April 2023.

The Telegraph reports that a working pensioner earning £60,000 a year will go from paying nothing to paying £630 a year in National Insurance on top of Income Tax.

The government has proposed a cap on lifetime social care costs

Currently in England, if people have assets worth more than £23,250 then they must pay for their social care and there is no cap on the costs.

Under the new system, anyone with assets below £20,000 will not have to pay anything towards their care. Those with assets from £20,000 to £100,000 and above will have to contribute, on a sliding scale. This depends on contributions from local authorities, which deliver much of social care.

People in this bracket will not contribute more than 20% of their assets each year and, once their assets are worth less than £20,000, they would pay nothing more. However, they might still contribute from any income they receive.

Those with assets above the £100,000 threshold must meet all fees until the value of their assets fall below this amount.

Boris Johnson also announced a lifetime social care “cap” of £86,000, meaning that no individual will be asked to pay more than this sum for care in their lifetime.

This new means test system and the £86,000 cap will come into force in October 2023.

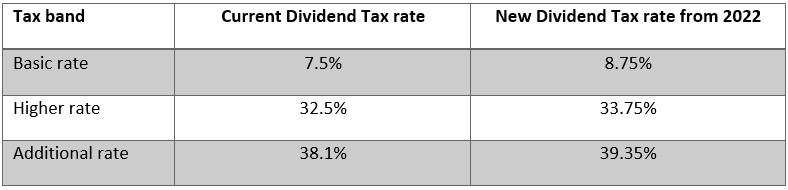

Dividend Tax is set to rise from April 2022

Alongside the National Insurance rise, Dividend Tax rates will also increase by 1.25% from April 2022. This change will mostly affect investors and business owners.

If you take home more than £2,000 a year in dividends, you will face a slightly higher bill regardless of your Income Tax band.

For example, if you’re a basic-rate taxpayer receiving £3,000 in dividends then you will pay Dividend Tax on £1,000. The government’s proposed changes mean that your bill will rise from £75 to £87.50.

Alternatively, if you’re a higher-rate taxpayer taking £10,000 in dividend payments then you would pay 33.75% on £8,000 of dividends. This would result in a Dividend Tax bill of £2,700, up £100 from the current system.

The government will suspend the State Pension triple lock for one year

In a move designed to save the government around £8 billion a year, work and pensions secretary, Thérèse Coffey, broke a second manifesto commitment by announcing that she was suspending the State Pension triple lock for one year.

She told the House of Commons that sticking to the triple lock – which promises that the State Pension will rise by the highest of inflation, earnings, or 2.5% – would be unfair, given that wages were increasing at a rate of well over 8% a year.

The distortion to national average earnings has been caused by the pandemic, as earnings fell at the start of the first lockdown before rising sharply as the furlough scheme ended. Had the government stuck to its commitment, pensioners would have expected an increase of between 8% and 9%.

Instead, the State Pension will rise more modestly in 2022 – either by 2.5% or price inflation. All eyes will now be on September’s inflation figure (announced in October) to determine how much the State Pension will rise next April.

Our View

Parliament has approved the proposals so it’s now a done deal…extra taxes to repair the NHS and restructure the social care funding system. The good news is that no-one will now have to sell their homes or use their children’s inheritance to fund their care, as post-2023 care costs will be capped at £86,000.

However, it’s not as black and white as the political spin would have you believe. Let’s consider a hypothetical example, based on our experience advising on social care funding over the last seven years.

The important qualification is that the social care cap only applies to the cost of the care, not the costs of accommodation, food, property maintenance, the management team etc.

In our corner of England, residential social care typically costs circa £60,000 per annum. The average carer to residents ratio is 1 carer per 6 – 8 residents. However, we will be generous and assume it’s 1:4, with a total salary cost of £40,000 per year including employer National Insurance and pension contributions, again almost certainly an overstatement.

On these assumptions the care cost per resident is just £10,000 per year, taking 8.6 years to hit the £86,000 cap. But the cap doesn’t come into place until 01 October 2023 and nothing has been said about it being retrospective.

What does this mean if you or a family member are looking at funding residential social care today? The full £60,000 per year bill is entirely self-funded for the next two years. Then the cap clock starts, but you’re still paying the full £60,000 per year for a further 8.6 years… that’s March 2012. Only then will your contribution be reduced to £50,000 per year.

Care providers will now have to identify specific care costs. Will there be a standard formula for pricing care or will it be left to the discretion of the provider?

The need to have early family discussions about the care you would want and how you expect it to be funded hasn’t suddenly changed. Realistically, we expect that few of our client families will benefit from the new £100,000 means-tested capital threshold or the care cap.

Get in touch

If you have any questions about how the National Insurance increase, Dividend Tax rise, or triple lock suspension will affect you and your finances, please get in touch.