The folly of leaving cash in the bank as inflation soars

Recent figures from the Bank of England (BoE), published in the Telegraph, confirm that nearly £1 trillion is languishing in easy access accounts with rates as low as 0.01%.

While some easy access savings accounts offer rates as high as 1.56% (according to Moneyfacts figures as of 5 August 2022), all easy access accounts offer lower returns than the current base rate of 1.75%.

As clients of HarperLees Financial Planning, you have probably spoken to us already about the danger of holding too much in cash in the current climate.

With inflation high and interest rates low, your cash savings are effectively losing value in real terms. Might now be the right time to turn to consider the added risk of an investment, with its greater chance of long-term growth?

Keep reading to find out.

High inflation erodes the value of your cash savings

The cost of living crisis has barely been out of the news this year, with millions of UK households struggling to make ends meet.

The Office for National Statistics revealed that inflation stood at a 40-year high of 10.1% in July 2022. Furthermore, the BoE has said that it expects inflation to be around 13% by the end of the year.

Global economies coming to terms with the Covid pandemic have been hit with supply chain crises, slow economic growth in China, and the effects of the war in Ukraine. You’ll have seen your own food and fuel bills rise, with a further increase in the energy price gap due in October.

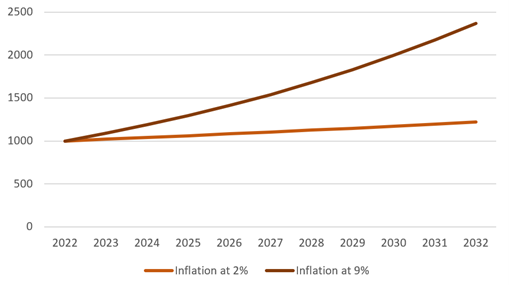

A quick look at the purchasing power of just £1,000, held over 10 years, shows the huge difference rising inflation can make.

Equivalent purchasing power of £1,000 over 10 years:

Source: CPI inflation calculator

With inflation at the BoE’s current target of 2%, you’d need just under £1,219 in 2032 to provide the same buying power as your £1,000 today. With inflation at 9%, however, you’d need £2,367 to match today’s £1,000 buying power.

As the cost of living rises, the buying power of your saved funds diminishes.

With the base rate well below current inflation levels – and easy access accounts failing to match this rate – your cash savings are effectively losing value in real terms.

Investment can offer you the chance for long-term growth

If you are thinking about starting to invest or increasing the size of your current portfolio, the first thing you’ll need to think about is your long-term goal.

Investing is a long-term proposition, aligned to your risk profile.

The value of your invested funds can fall as well as rise, but if you are in it for the long term, there is the potential for inflation-beating returns.

Back in 2019, Barclays compared the performance of £100 invested from 1899 to 2018. The report found that over the 119 years:

- £100 invested in cash grew in value to more than £20,000 by 2018

- £100 invested in gilts grew to almost £42,000 by 2018

- £100 invested in equities was worth around £2.7 million by 2018.

While your investment goal is unlikely to be a century away, the difference in performance is marked.

You’ll need to remain patient and remember that the reason for a long-term goal is to ride out periods of short-term volatility.

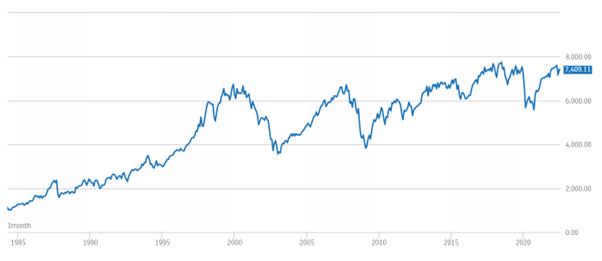

A look at the FTSE 100 index over the last three decades shows these short-term dips.

Source: London Stock Exchange

Additionally, the graph also shows the generally upward trend of the market.

The online trading platform IG looked at the investment performance of the FTSE 100 over the 35 years to 2019. They found that the average annual price return over that period was +6.8%.

Get in touch

The current economic climate of high inflation and low rates could spell disaster for your cash savings, but investing could be the answer.

Over the long term, investing offers the chance for inflation-beating returns, with added risk attached.

If you want to discuss your current level of cash savings or the benefits of investing, please feel free to get in touch. You can email us at info@harperlees.co.uk or call 01277 350560, we’re always happy to help.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article.