The Masterplan

Our masterplan for a return to the office has been underway. We have been busy preparing for the planned staff return on 1 September including a desk reorganisation, sanitisers, tissues and huge volumes of cleaning products!

Our approach is intended to get moving as guidance allows, whilst taking every precaution to keep our team, clients and connections safe. With this in mind, we will continue with virtual meetings wherever possible, until government advice supports a change to welcoming our clients back to the office.

In this edition, we include a market update with a view on what happens next, revisit financial scams and complete the HarperLees team’s Desert Island Discs series. We have all enjoyed sharing our selections and we intend to have ‘guest appearances’ in future newsletters. Please do not be shy!

Please click the links on all songs, films and activities throughout the Newsletter for your enjoyment.

HarperLees Wellbeing HUB

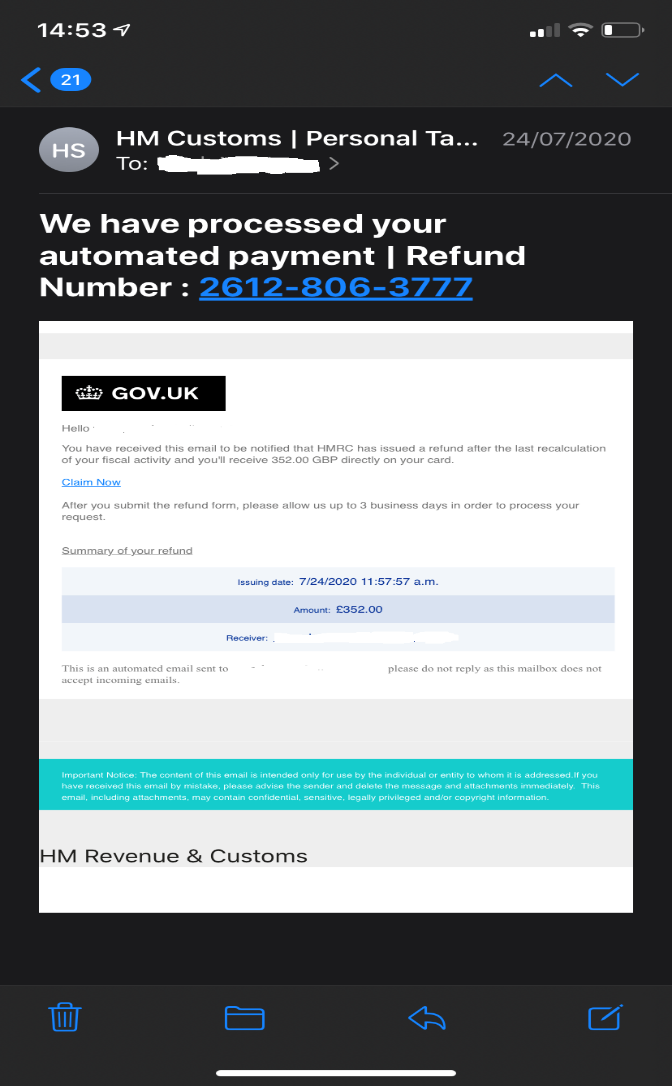

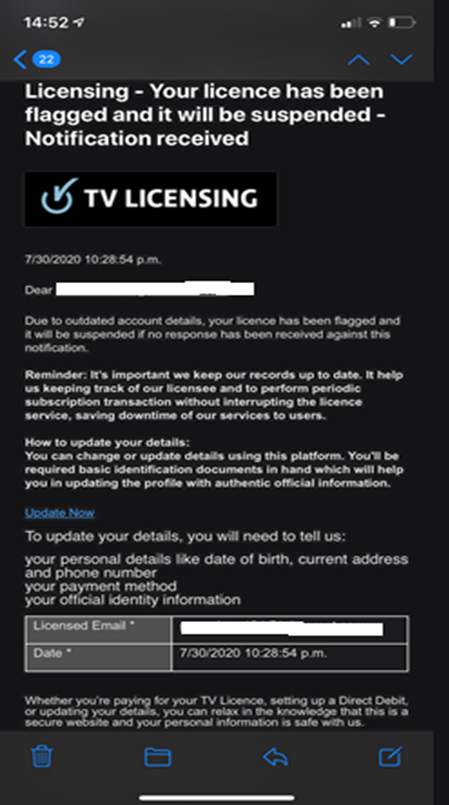

Although we have mentioned avoiding financial scams in previous Newsletters, our team received a couple of very convincing scam emails this week. We wanted to share them in case you receive similar.

These are classic scams:

- Preying on temptation or good fortune. Why would we not take that tax rebate and our guard goes down?

- Most people have a TV licence and this relies upon us immediately relating to the service or product that we recognise.

Our suggestions:

1) If you are not expecting the rebate / inheritance etc., it really is too good to be true!

2) Check the real sender. By clicking the sender (NOT the link) shown on the email, it uncovers the real email address. In our examples, the addresses contained a series of random letters and numbers followed by @telenet.be. The scams could have come through any internet provider, but if it is not showing the company or organisation, it is guaranteed to be a scam.

3) If in any doubt, never provide confidential information or click on the links.

4) Please let us know and we will be happy to guide you.

Desert Island Discs From HarperLees

Completing our HarperLees staff series, Louise MacLean shares her 8 songs, book and luxury item:

Everlong – Foo Fighters – so many memories linked to this song, including walking up the aisle to an acoustic version.

Take on Me – Aha – the first song I can remember really liking and, of course, there is the video!

Fingers of Love – Crowded House – I used to listen to the Together Alone on my Walkman and listening to this now takes me back to my teenage years.

The Flood – Take That – reminds me of driving along the east coast of Australia in a motorhome with no radio signal and just one CD…

Madness – Muse – this would come on the radio when my eldest was a baby and I’d be dancing to this while trying to persuade her to eat!

Masterplan – Oasis – originally a ‘b side’ on a CD single, this song reminds me of my university days when I had more time for music.

The Sky is a Neighbourhood – Foo Fighters – a more recent song from my favourite band and it quickly became one of my favourites, as my daughters soon worked out.

I’m Only Happy When It Rains – Garbage – another of my favourite bands, not exactly an uplifting title but possibly apt if stuck on a remote island!

Book: The Silmarillion by J. R. R. Tolkien – I have read the Hobbit and the Lord of the Rings but never found the time to tackle this one.

Luxury item: A swiss army knife as it could come in handy.

Market Update

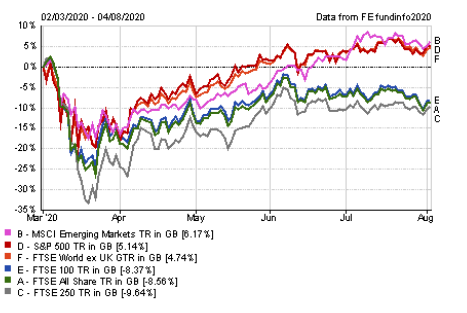

There has been much conjecture on whether the market recovery would be L, U, V or W shaped. It is timely to look at the progress so far which can be illustrated by a selection of world stockmarket indices:

World markets have followed a V shape with values now standing higher than the pre-Covid19 impact in March and also from the start of 2020. However, you will notice that the main UK markets resembling more like the dreaded ‘L’ shape. Perhaps shackled by BREXIT (do you remember when this filled every conversation?) in part, but also heavily influenced by currency with the FTSE 100 particularly full of international companies. Hopefully, we will see improvements in the UK market to turn the L into a U shape recovery.

This is another reminder of the benefits of taking a diversified approach and decision making with a longer-term view.

Of course, the golden question is what happens next……

Vanguard UK, one of our investment partners, provide an interesting commentary on the challenges facing world economies, titled ‘Fear-onomics’ and their view of how the future could unfold.

Contacts and Advice

We hope you have found our newsletters informative and entertaining and welcome your ideas for future content.

With the lockdown phase now relaxed and the majority able to stop shielding, we have decided that the time is right to reduce the frequency of our updates to monthly.

As always, thank you to all who have contacted us with positive feedback or shared the newsletter with friends and family. We are very appreciative to those who have referred others for our services.

Please contact us at any time for assistance.