Will your returns suffer if you align your investments with your ethics?

According to the Office for National Statistics (ONS), 74% of UK adults are worried about climate change. If you are environmentally conscious and are looking to invest in companies that have clear environmental, social and governance (ESG) strategies closely aligned to yours, accessing relevant and correct information can be a challenge.

Indeed, a report by the Saltus Wealth Index suggests that fewer than half of high net worth individuals (HNWIs) are investing in ESG due to a perceived lack of returns and the legitimacy of social and green impact funds.

So, read on to find out what ESG investing is, why individuals are concerned about investing in ESG funds and why their fears may not be warranted.

What is “ESG investing”?

ESG investing refers to a set of standards for a company’s behaviour that are used by socially conscious investors to inform their investment decisions.

The investor may want the company to focus on things like reducing their carbon footprint, tackling social issues like discrimination in the workplace, and rooting out corruption and mismanagement.

It is not only a way for investors to identify companies that have strategies that align with their own ethics but also a strong motivation for companies to act responsibly. Socially and environmentally conscious investors will be looking for companies that are good corporate citizens, responsible stewards of the environment, and are led by accountable managers and owners.

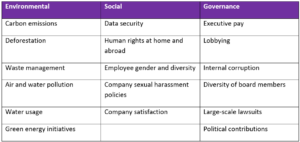

The table below details some of the different aspects that are considered by ESG investors.

Aside from the benefit of finding a company that matches your values and ethics, investing in ESG funds can also help you avoid the risk of investing in a company that is eventually held accountable for unethical practices.

A poor ESG rating can act as a deterrent to investors and is a simple way for them to avoid unethical companies or funds.

What is causing investor hesitation?

Some high net worth individuals have concerns over investing in ESG funds, with four reasons causing their hesitation.

1. Perceived lower returns

Some investors are concerned that by investing in companies that focus on environmental, social, and governance factors, they could be accepting lower returns. Investors believe that while ESG funds are generally seen as low risk, the returns gained won’t be as high.

Aside from the environmental and ethical benefits, investing in ESG funds could potentially lead to similar returns to those without ESG criteria. In fact, a recent report from FTAdviser in April 2023 revealed that adding environmental, social and governance criteria to an investment portfolio doesn’t necessarily affect returns.

For example, of the six Exchange-Traded Funds (ETFs) tracked by Research Affiliates, the five with ESG criteria saw a similar performance to the one without.

2. Not enough evidence to back it up

Due to increased publicity around climate change, equality and diversity rights, and increased calls for better working conditions, ESG investing has been growing in popularity.

Despite this, some investors don’t feel like there is enough accurate information around to help them inform their investment decisions and match their values and ethics with a fund or company.

While sustainable investment options like ESG have been around for decades, accurate and clear information hasn’t always been the easiest to find. However, guidance and advice are improving and developing all the time, with issues like climate change and equality and diversity rights becoming increasingly important.

Having much more accessible information not only helps you carry out your own due diligence and research on potential ESG funds that match your ethics, but it also enables you to work with a financial planner knowing you’re armed with all the information you both need to identify the most optimum ESG investment opportunities for you.

3. ESG investment being potentially more costly

Although the amount of accurate information and awareness of ESG investing has gradually increased over the years, there has often been a misconception about the performance of ESG and sustainable investing and just how costly it is for potential investors.

Many investors believe that investing in ESG would be more costly to them and that many funds prove to be more expensive investments on average. According to research carried out by ESG Investing, companies that focus on ESG tend to be valued higher than non-ESG companies.

However, because these companies tend to trade on higher valuations, investors that back them have the potential to make money from these rising valuations. Similarly, while currently it may cost more to invest in ESG funds, the companies that pay attention to ESG principles are less at risk from changes in regulation, or consumer preferences and behaviour than their non-ESG counterparts.

4. The risk of greenwashing

Despite ESG investing’s increasing popularity, some investors are concerned about the potential for “greenwashing”. This is where a company is less environmentally conscious than they claim to be, deliberately or accidentally exaggerating or overstating their ESG credentials.

Aside from leading to misleading figures on global efforts to reach net-zero targets, it can also potentially damage investor confidence. For example, a report by Sensu Insight suggests that 71% of Brits don’t believe that environmental claims by businesses have been verified or checked by an independent regulator.

A consultation paper organised by the government has been issues to stakeholders with the aim of improving transparency and good conduct in the ESG ratings market.

Focusing on a future regulatory regime for ESG ratings providers, the consultation is designed to define key concepts and help investors place their money with confidence. In addition, the potentially improved transparency and conduct could help reduce the risk of greenwashing in the future, too.

Speak to a financial planner if you are considering ESG investments

Regardless of whether you are considering investing in an ESG fund or not, working with a financial planner could hold you in good stead.

By helping you to identify your financial goals and highlight what ethics and values are most important to you and any company or fund you invest in, a financial planner could enable you to find the most suitable investment opportunities for your ethics and your financial circumstances.

To find out how we can help you achieve your goals, please email info@harperlees.co.uk or call 01277 350560.

Please note

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.