That was the year that was: 7 important personal finance stories from 2022

As Britain looks forward to some festive cheer after a year with plenty of financial – and political – twists and turns, you may be reflecting on what 2022 meant for you. It’s something we have been doing at HarperLees Financial Planning too.

So, with this in mind, discover seven important personal finance stories from the year and what they could mean for your wealth.

1. Inflation soared to new highs

Britain started the year still dealing with the Covid pandemic, which had already caused supply chain issues and a steep increase in energy prices. This was not helped by Brexit or Russia’s invasion of Ukraine in February, which pushed energy and food prices up even further.

As a result, inflation – which measures the rising cost of living – became one of the main financial stories of 2022. According to the Office for National Statistics, it reached 10.7% in November. While this was down from 11.1% the month before, it was still close to the highest level in 40 years.

There may be some good news though, as a report by This is Money reveals inflation in the UK could drop significantly in the second half of 2023. As clients of HarperLees Financial Planning we will have discussed how you may be able to inflation-proof your wealth, although if you would like to find out more, read our informative blog.

2. Interest rates continued to rise

Historically, interest rates are used to reduce soaring inflation as it helps tackle one of its main drivers: consumer demand. One way it does this is by increasing the cost of borrowing, which in turn, pushes up mortgage repayments for homes with certain types of mortgages.

As a result many households have less disposable income, meaning they don’t have as much money to spend on the high street. In 2022, the Bank of England (BoE) raised its rates nine times in a row, increasing it from 0.1% in December 2021 to 3.5% in December.

According to the Guardian, when the BoE increased its rate by 0.75% in November, those with a £150,000 repayment tracker mortgage with 20 years remaining saw their repayments increase by £59 a month.

While interest rates are likely to increase in 2023, another article by the Guardian provides some comfort. It reveals the BoE’s rates may not reach 5.25% as previously predicted by the financial markets.

3. Kwasi Kwarteng unveiled his doomed “mini-Budget”

One of the most significant financial events of 2022 was former chancellor Kwasi Kwarteng’s “mini-Budget”. It aimed to stimulate Britain’s economy with a swathe of tax cuts and intervention into the energy markets.

Yet it resulted in the pound falling to an all-time low against the dollar, the FTSE 100 dropping, and a rebuke from the International Monetary Fund (IMF). If that wasn’t enough, the BoE announced an emergency bail-out to reassure the bond markets and mortgage lenders withdrew products over fears interest rates would spiral.

As a result, Kwarteng resigned and the then prime minister, Liz Truss, did so soon afterwards. Interestingly, Truss’s departure resulted in sterling initially strengthening against the dollar, which suggests the financial market viewed her departure as a good thing for the British economy.

According to the Guardian, the mini-Budget cost the UK a staggering £30 billion according to the independent Resolution Foundation. To learn more about the mini-Budget, read our insightful blog.

4. The tax threshold freeze was extended

During his autumn statement in November, the chancellor, Jeremy Hunt, announced that he was extending the freeze on certain tax thresholds. The freezes, which came into effect in April 2022, will now run until 2028, not 2026.

As a result, the Personal Allowance – which is the amount you can earn before Income Tax is charged – will stay at £12,570, and the higher-rate tax threshold will remain at £50,270. Additionally, the Inheritance Tax (IHT) thresholds will remain at between £325,000 and £1 million until 2028.

The latter is the amount you can have in your estate before it’s liable to IHT, which is typically charged at 40%. According to the Telegraph, the extended freeze on the IHT threshold could result in the average household’s liability ballooning from £215,652 in 2019/20 to £283,000 in 2027/28.

The paper also reported that millions of workers will be pushed up into higher Income Tax brackets because of the extended freeze. As clients of HarperLees Financial Planning, you have peace of mind that if you are now exposed to higher taxation, we are here to help you mitigate it as much as possible, and potentially negate it.

5. Certain tax allowances are to be reduced – significantly

In his autumn statement, Mr Hunt also announced that the Capital Gains Tax (CGT) threshold would see a substantial drop. As from April 2023, it will fall from £12,300 to £6,000, and then to £3,000 as from April 2024.

Additionally, the Dividend Tax allowance of £2,000 will drop to £1,000 in April 2023 and £500 in 2024. The reduction comes after Dividend Tax rates increased in April, meaning the basic-rate rose to 8.75%, the higher-rate rose to 33.75% and the additional-rate increased to 39.35%.

To learn more about 2022’s various tax changes and how we can help, read our recent blog.

6. Britain is facing a recession (if it’s not already in one)

With all the financial challenges throughout the year, an article by Sky News is not likely to come as a surprise. It reveals that the Confederation of British Industry (CBI), the nation’s largest business group, has said the UK is finishing 2022 in a recession.

Furthermore, it downgraded the nation’s economic growth outlook for 2023 from 1% growth to a contraction of 0.4%, meaning the recession will continue into next year. The findings dovetail into warnings by the BoE, which said in November that the UK’s economic growth will be in negative territory in 2023.

However, it is important to remember that stockmarkets are valuing on future expectations and it is reasonable to expect that the recession risk is already priced in. As such, the recovery of markets may come before the ‘real economy’ stabilises.

Please remember that as a client, we are here to help your wealth weather the financial storm a recession may bring. That said, recessions can also provide opportunities when it comes to investments, something we also covered in one of our blogs.

7. The stock market saw a volatile year

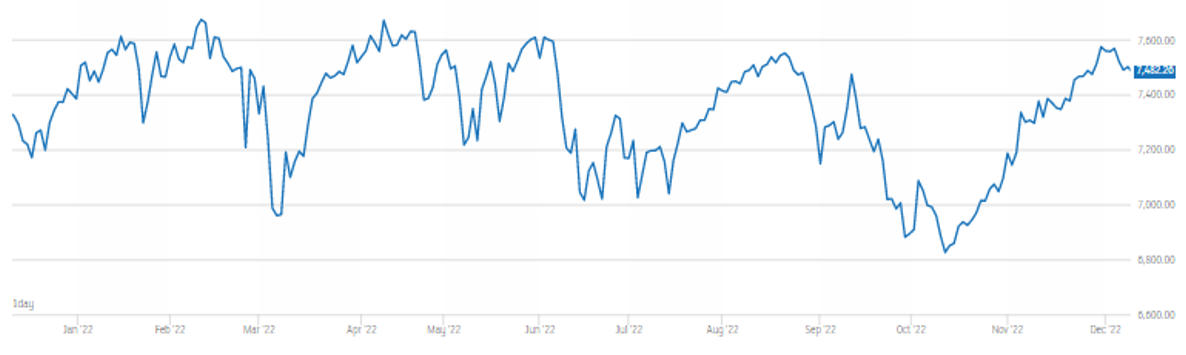

When you consider the war in Ukraine, soaring inflation, rising interest rates and the political and financial fallout of the mini-Budget, it’s not surprising that the stock market has been volatile. The following illustration shows the performance of the FTSE 100 between 3 January and 8 December 2022.

The index follows the performance of the top 100 companies registered on the London Stock Exchange.

As you can see from the values on the right-hand axis, while the index ended the period higher, there were plenty of downturns along the way – several of which were significant. When the stock market is volatile, it’s worth remembering that short-term downturns should always be expected when investing. The volatility can also bring opportunity, particularly if making regular payments.

As a client of HarperLees Financial Planning you will already know that more often than not the best strategy is to focus on your long-term goals, remain calm and stay invested. If you know someone with investments that is worrying about the challenging economic climate and the effects it’s having on the stock market, we would be happy to talk to them.

Get in touch

As you can see, plenty has happened in 2022 and this is not even a comprehensive list of the year’s events. This means your financial situation, investments and wider wealth could be affected.

If you, a friend or family member would like to discuss how this year’s events might affect your wealth or tax efficiency, we would be happy to have a conversation. Please feel free to email us on info@harperlees.co.uk or call 01277 350560.

Please note that the office will close for your Christmas break at 5pm on Friday 23 December and reopen at 9am on Tuesday 3 January.

Please note

This blog is for general information only and does not constitute advice. It should not be seen as a substitute for financial advice as everyone’s situation will be different.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation that is subject to change. The information is aimed at retail clients only.

Investments carry risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.